Not for distribution to United States news wire services or for dissemination in the United States

Toronto, Ontario – October 15, 2024 – Doré Copper Mining Corp. (“Doré Copper”) (TSXV: DCMC; OTCQB: DRCMF; FRA: DCM) is pleased to announce that it has entered into a definitive arrangement agreement (the “Agreement”) on October 14, 2024 with Cygnus Metals Limited (ASX: CY5) (“Cygnus”) to combine their respective businesses in a merger of equals transaction, pursuant to which Cygnus has agreed to acquire 100% of the issued and outstanding common shares of Doré Copper (the “Doré Copper Shares”) by way of a court approved plan of arrangement under the Canada Business Corporation Act (the “Transaction”).

This Transaction will create a Québec-focused critical minerals explorer and developer with high-grade copper and lithium resources. The merger of equals will bring together proven members of management with strong capital markets experience, project development, mine building and operational expertise and a proven track record of mineral discoveries.

Pursuant to the terms of the Agreement, holders of Doré Copper Shares will receive 1.8297 ordinary shares of Cygnus (“Cygnus Shares”) in exchange for each Doré Copper Share (the “Exchange Ratio”) held immediately prior to the effective time of the Transaction (the “Effective Time”). The Exchange Ratio is based on an approximate 5-day volume-weighted average price of Doré Copper Shares on the TSX Venture Exchange (“TSXV”) and Cygnus Shares on the Australian Stock Exchange (“ASX”) as at October 11, 2024. This represents an implied value of C$0.141 per Doré Copper Share and an implied equity value for Doré Copper of C$24 million. As of the date of theAgreement, existing shareholders of Doré Copper (“Doré Copper Shareholders”) and shareholders of Cygnus will own approximately 45% and 55%, respectively, of the outstanding Cygnus Shares following completion of the Transaction (before taking into account the Cygnus Equity Raise (as defined below)). In connection with the Transaction, Cygnus intends to complete an equity raise of Cygnus Shares for aggregate gross proceeds of up to a maximum of A$11 million (with a minimum of A$5 million) (the “Cygnus Equity Raise”). The net proceeds of the Cygnus Equity Raise are expected to be used for, among other things, advancing the Chibougamau project (assuming the Transaction is completed) and Cygnus’ James Bay lithium projects. Pursuant to the Agreement, Cygnus has covenanted to use commercially reasonable best efforts to complete the Cygnus Equity Raise.

Transaction Strategic Rationale

- Diversified Pipeline and Geographical Synergies: The addition of Cygnus’ quality lithium projects in James Bay, Québec, including Pontax, Auclair and Sakami, to Doré Copper’s high-grade copper assets, expands the asset portfolio of the combined company and provides an opportunity to leverage potential geographical synergy between the lithium properties and Doré Copper’s processing facility near Chibougamau.

- Strong Combined Management: The combined company is expected to benefit from the unique combination of Cygnus’ and Doré Copper’s management teams providing for strong capital markets experience and proven exploration success, project development and operational expertise.

- Capital Markets Presence and Financial Strength: As Cygnus intends to apply for and obtain the listing of the Cygnus Shares on the TSXV as a condition to closing, the Transaction represents an opportunity to elevate the global profile and capital markets presence of the combined company with a dual ASX and TSXV listing.

- Supported Transaction: The Transaction is supported by Doré Copper’s largest shareholders and key strategic investors, Ocean Partners Holdings Limited (“Ocean Partners”) and Equinox Partners Investment Management, LLC (“Equinox Partners”), as well as its directors and officers, who have entered into voting support agreements.

Doré Copper President and Chief Executive Officer, Ernest Mast, commented: “The Doré Copper team is looking forward to working with the Cygnus team to create a critical metals company and to maximize the value of our quality assets in Chibougamau. This merger will provide the funding, additional expertise and the strategy to generate superior shareholder returns through brownfields exploration and to implement a profitable hub-and-spoke operation in the Chibougamau mining camp.”

Cygnus Executive Chairman, David Southam, stated: “This merger is an exceptional opportunity to create value for both groups of shareholders. By combining the proven exploration and management skills of the Cygnus team with the high-grade copper resources and immense upside potential at the Chibougamau properties, we have the potential to unlock substantial value. We intend to devise and implement an aggressive exploration program, utilizing highly experienced geologists and the latest technology, with the aim of driving strong resource growth at a time when the world desperately wants more copper from tier-one locations.

Being able to combine our skill sets with a Québec-based team who has experience in building large resource projects with support from the local communities also provides us with those local connections and experience to assist in advancing our lithium projects in a better macro environment.”

Benefits to Doré Copper Shareholders

- Enhanced Liquidity: The increased size of the combined company and anticipated dual listing (ASX and TSXV) of the Cygnus Shares is expected to provide for greater liquidity and access to additional capital markets for shareholders of the combined company.

- Diversification of Asset Base: Doré Copper Shareholders will gain exposure to Cygnus’ quality lithium projects in James Bay, Québec, including the Pontax project, with its JORC Mineral Resource Estimate, while retaining participation in any future upsize from the Chibougamau high-grade copper assets and Doré Copper’s exploration portfolio.

- Pathway for Accelerated Exploration to Enhance Hub-and Spoke Operation Model: It is expected that the combined company will systematically explore the Chibougamau mining camp using modern exploration techniques and geophysics with the objective of growing the resource inventory.

- Leveraging Cygnus Team Proven Track Record of Success in Both Exploration, Development and Production Companies: The Cygnus team has been involved in certain transactions which returned significant shareholder value over time such as Bellevue Gold, Mincor Resources, Firefly Metals Limited, Andean Silver Limited, Ramelius Resources and Kidman Resources.

Summary of Transaction Terms

Pursuant to the terms and conditions of the Agreement, Doré Copper Shareholders will receive 1.8297 fully paid Cygnus Shares for each Doré Copper Share held immediately prior to the Effective Time, implying a consideration of C$0.141 per Doré Copper Share. In addition, (i) all outstanding stock options of Doré Copper immediately prior to the Effective Time shall be exchanged for replacement options of Cygnus and exercisable to acquire such number of Cygnus Shares at such exercise price in accordance with the Exchange Ratio, (ii) all outstanding deferred share units of Doré Copper immediately prior to the Effective Time (whether vested or unvested) will be deemed to have been unconditionally vested and immediately redeemed and cancelled in consideration for Doré Copper Shares prior to the exchange for Cygnus Shares; and (iii) all outstanding warrants of Doré Copper will be adjusted in accordance with their terms and become exercisable, based on the Exchange Ratio, to purchase Cygnus Shares on substantially the same terms and conditions.

The Transaction will be effected by way of a court-approved plan of arrangement under the Canada Business Corporations Act and will require the approval of (a) at least 66 2/3% of the votes cast by Doré Copper Shareholders, and (b) if necessary, a simple majority of the votes cast by Doré Copper Shareholders, excluding certain related parties as prescribed by Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions, in each case, voting in person or represented by proxy at a special meeting of Doré Copper Shareholders to consider the Transaction (the “Doré Meeting”). The Doré Meeting is expected to be held in December 2024.

Doré Copper’s major shareholders, Equinox Partners and Ocean Partners and each director and officer of Doré Copper, representing, in the aggregate, approximately 61.34% of the issued and outstanding Doré Copper Shares, have entered into voting support agreements with Cygnus, pursuant to which each of them has agreed to, among other things, vote in favour of the Transaction at the Doré Meeting.

The Agreement includes customary representations and warranties for a transaction of this nature as well as customary interim period covenants regarding the operation of Cygnus’ and Doré Copper’s businesses. The Agreement also provides for customary deal protection provisions including fiduciary-out provisions, non-solicitation covenants and a right to match any superior proposal as defined by the Agreement as well as a termination fee payable to Cygnus in certain circumstances.

Completion of the Transaction is subject to customary conditions, including, among others, court approval, regulatory approval and Doré Copper Shareholder approval. In addition to customary closing conditions, the Transaction is also subject to the receipt of conditional approval of the TSXV for the listing of the Cygnus Shares.

Subject to the satisfaction (or waiver) of all conditions to closing set out in the Agreement, it is anticipated that the Transaction will be completed in December 2024. Upon closing of the Transaction, it is expected the Doré Copper Shares will be delisted from the TSXV.

Further information regarding the Transaction will be included in a management information circular (the “Circular”) to be delivered to Doré Copper Shareholders in connection with the Doré Meeting. Copies of the Circular, the Agreement, the voting support agreements and certain related documents will be filed with the applicable Canadian securities regulators and will be available on SEDAR+ at www.sedarplus.ca.

Board of Directors and Management

Upon closing of the Transaction, it is presently anticipated that the board of the combined company will be comprised of three (3) directors from each of Cygnus and Doré Copper. In addition, it is expected that David Southam, current Executive Chair of Cygnus, will remain as Executive Chair of the combined company and Ernest Mast, current President and Chief Executive Officer of Doré Copper, will be the President and Managing Director of the combined company. The remainder of the board of the combined company will be comprised of two (2) non-executive directors from each company: Kevin Tomlinson (Canada based) and Raymond Shorrocks (Australia based) from Cygnus, and Mario Stifano, current Executive Chairman of Doré Copper, and Brent Omland from Doré Copper.

Special Committee and Board Recommendations and Fairness Opinion

The board of directors of Doré Copper (the “Board”), having received a unanimous recommendation from a special committee comprised solely of independent directors of Doré Copper (the “Special Committee”) and after receiving outside legal and financial advice, unanimously determined that the Transaction is in the best interests of Doré Copper and is fair to the Doré Copper Shareholders and unanimously recommends that Doré Copper Shareholders vote in favour of the Transaction. In making their respective determinations, the Board and the Special Committee considered, among other factors, the oral fairness opinion of Paradigm Capital Inc. (“Paradigm Capital”)to the effect that as of the date hereof, subject to the assumptions, limitations and qualifications contained in its opinion, the consideration to be received by Doré Copper Shareholders pursuant to the Transaction is fair, from a financial point of view to the Doré Copper Shareholders. A copy of the fairness opinion of Paradigm Capital will be included in the Circular.

Advisors and Counsel

Doré Copper has engaged Paradigm Capital, who has provided a fairness opinion in respect of the Transaction, Bennett Jones LLP as Canadian legal advisor and Thomson Geer as Australian legal advisor in relation to the Transaction.

Cygnus has engaged Canaccord Genuity Corp. as financial advisor, Hamilton Locke as Australian legal advisor and Osler, Hoskin & Harcourt LLP as Canadian legal advisor in relation to the Transaction.

Canaccord Genuity and Euroz Hartleys are acting as joint lead managers to the Cygnus Equity Raise.

Qualified Persons

All scientific and technical data contained in this news release has been reviewed and approved by Ernest Mast, P.Eng, President and CEO of Doré Copper, and Jean Tanguay, P.Geo., General Manager of Doré Copper, Qualified Persons within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

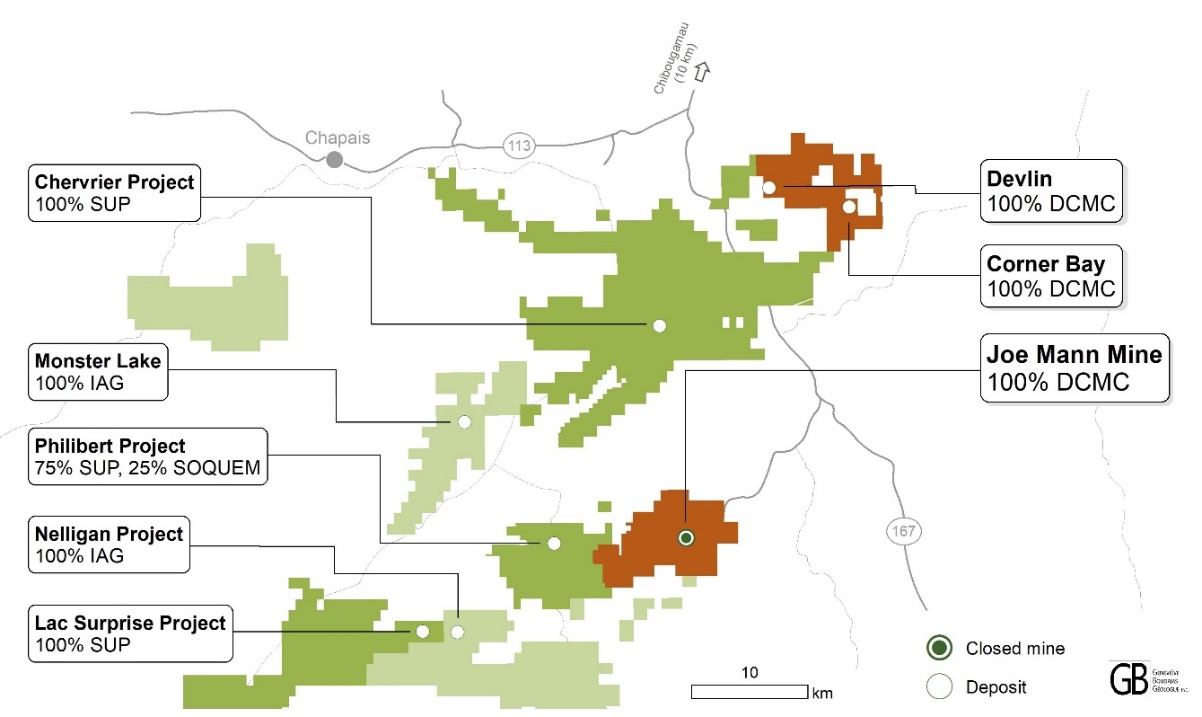

About Doré Copper Mining Corp.

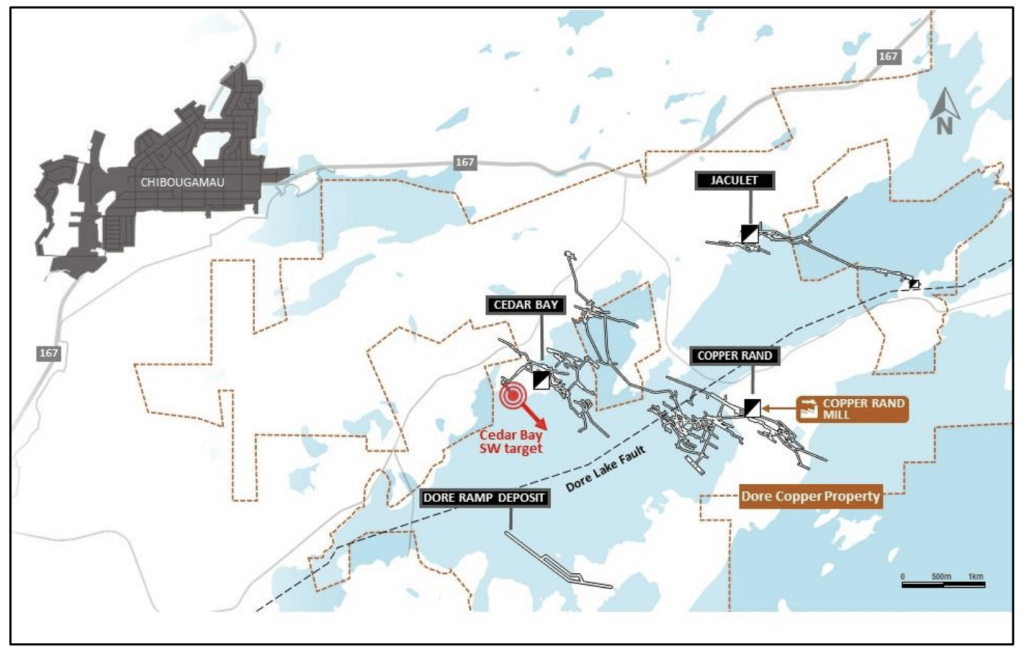

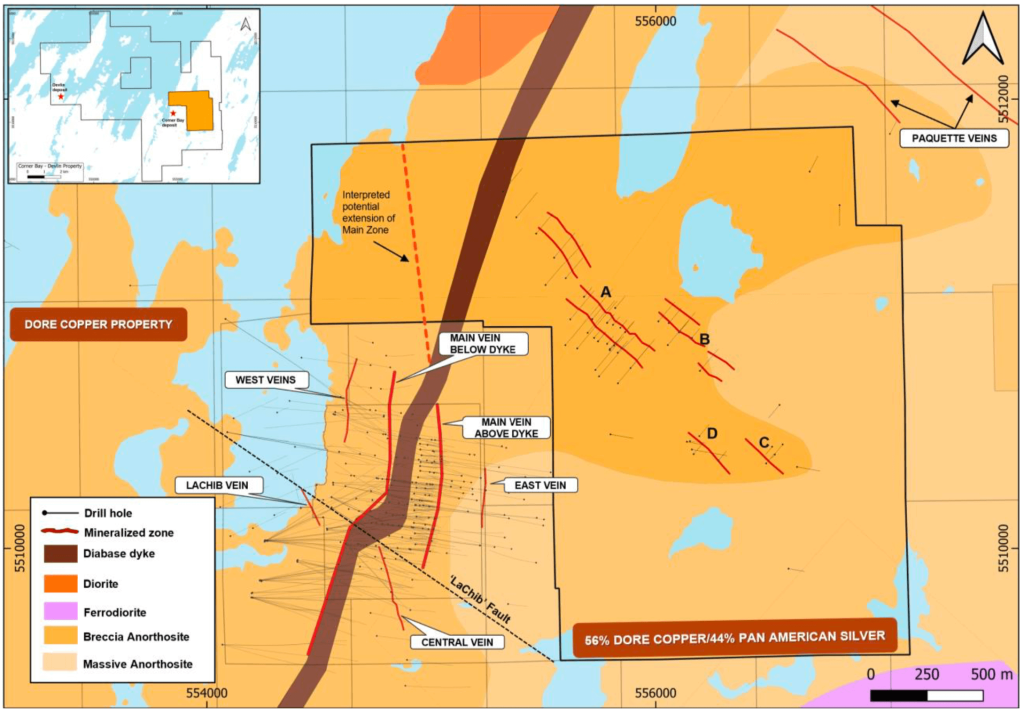

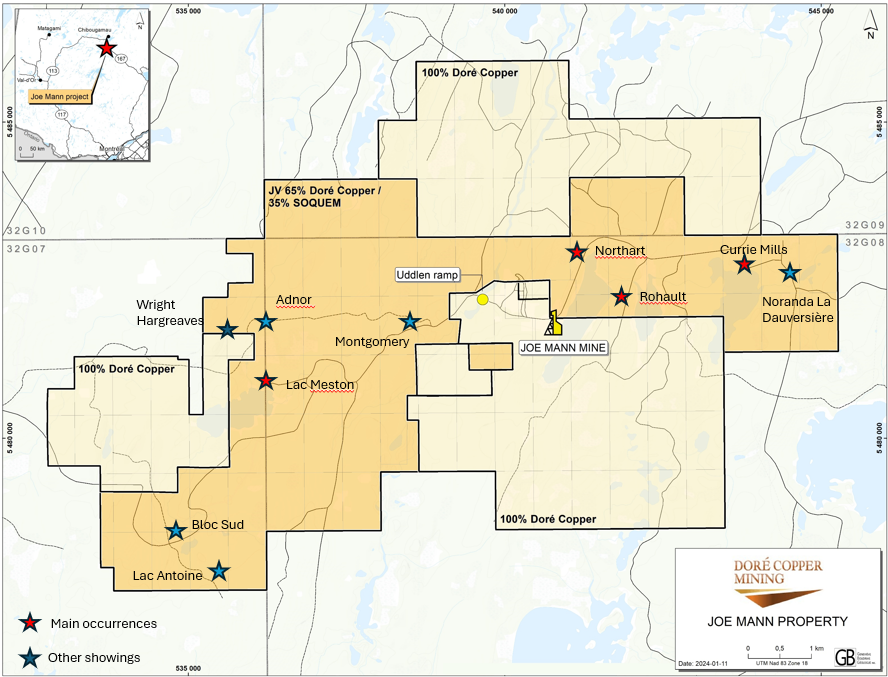

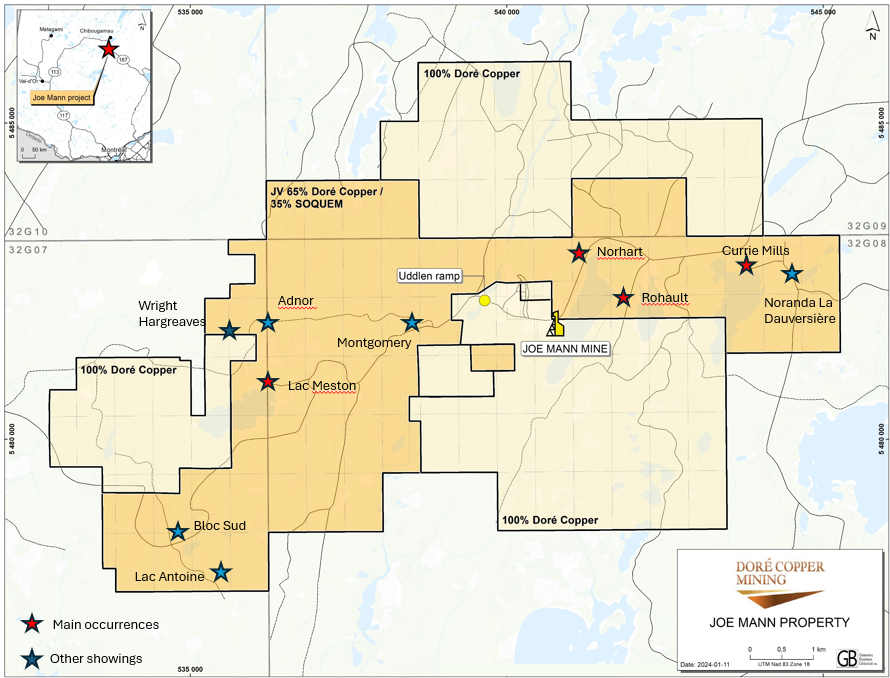

Doré Copper Mining Corp. aims to be the next copper producer in Québec with an initial production target of +50 million pounds of copper equivalent annually by implementing a hub-and-spoke operation model with multiple high-grade copper-gold assets feeding its centralized Copper Rand mill. Doré Copper has delivered its PEA in May 2022 and is proceeding with a feasibility study. Doré Copper has consolidated a large land package in the prolific Lac Doré/Chibougamau and Joe Mann mining camps that has historically produced 1.6 billion pounds of copper and 4.4 million ounces of gold. The land package includes 13 former producing mines, deposits and resource target areas within a 60-kilometer radius of Doré Copper’s Copper Rand Mill.

About Cygnus Metals

Cygnus Metals Limited (ASX: CY5) is an emerging exploration company focused on advancing the Pontax Lithium Project (earning up to 70%), the Auclair Lithium Project and the Sakami Lithium Project in the world class James Bay lithium district in Québec, Canada. In addition, Cygnus has REE and base metal projects at Bencubbin and Snake Rock in Western Australia. The Cygnus Board of Directors and Technical Management team have a proven track record of substantial exploration success and creating wealth for shareholders and all stakeholders in recent years. Cygnus’ tenements range from early-stage exploration areas through to advanced drill-ready targets.

For further information about Doré Copper, please contact:

Ernest Mast

President and Chief Executive Officer

Phone: (416) 792-2229

Email:

Laurie Gaborit

VP Investor Relations

Phone: (416) 219-2049

Email:

For more information, please visit: www.dorecopper.com

Facebook: Doré Copper Mining

LinkedIn: Doré Copper Mining Corp.

Twitter: @DoreCopper

Instagram: @DoreCopperMining

- Based on the Exchange Ratio multiplied by the closing price of Cygnus Shares on the ASX of A$ 0.083 on October 11, and converted to C$0.077 using AUD/CAD exchange rate of 0.9277.

- Based on the implied value of the Doré Copper Shares multiplied by Doré Copper’s 169,258,863 undiluted shares.

- Technical report titled “Preliminary Economic Assessment for the Chibougamau Hub-and-Spoke Complex, Québec, Canada” dated June 15, 2022, in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The Technical Report was prepared by BBA Inc. with several consulting firms contributing to sections of the study, including SLR Consulting (Canada) Ltd., SRK Consulting (Canada) Inc. and WSP Inc.

- Sources for historic production figures: Economic Geology, v. 107, pp. 963–989 – Structural and Stratigraphic Controls on Magmatic, Volcanogenic, and Shear Zone-Hosted Mineralization in the Chapais-Chibougamau Mining Camp, Northeastern Abitibi, Canada by François Leclerc et al. (Lac Dore/Chibougamau mining camp) and NI 43-101 Technical Report on the Joe Mann Property dated January 11, 2016 by Geologica Groupe-Conseil Inc. for Jessie Ressources Inc. (Joe Mann mine).

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this news release, including, without limitation, statements with respect to the proposed Transaction and the terms thereof, the proposed benefits to be derived from the Transaction, including, but not limited to, the goals, strategies, opportunities, technologies used, project timelines and funding requirements, impact of combined management expertise and prospective shareholding, the anticipated date of the Doré Meeting, the anticipated filing of materials on SEDAR+, the completion of the Transaction, including, receipt of all necessary court, shareholder and regulatory approvals and timing thereof, the proposed Cygnus Equity Raise and the terms thereof, the proposed use of proceeds of the Cygnus Equity Raise, the expectation that the Doré Copper Shares will be delisted from the TSXV, the expectation that the Cygnus Shares will be dual-listed on the ASX and TSXV, and the plans, operations and prospects of Doré Copper and its properties are forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the ability to obtain approvals in respect of the Transaction and to consummate the Transaction, the ability to obtain approvals for the listing of the Cygnus Shares on the TSXV, the ability to complete the Cygnus Equity Raise and the timing thereof, integration risks, actual results of current and future exploration activities, benefit of certain technology usage, the ability of prior successes and track record to determine future results, changes in project parameters and/or economic assessments, availability of capital and financing on acceptable terms, general economic, market or business conditions, future prices of metals, uninsured risks, risks relating to estimated costs, regulatory changes, delays or inability to receive required regulatory approvals, health emergencies, pandemics and other exploration or other risks detailed herein and from time to time in the filings made by Doré Copper with securities regulators. Although Doré Copper has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Doré Copper disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

- 2024-10-15 Dore Copper and Cygnus Metals Enter Into Arrangement Agreement To Create Strategic Critical Minerals Company

- 2024-09-26 Doré Copper announces closing of $4.676 million non-brokered private placement of common shares and flow-through shares

- 2024-09-04 Dore Copper announces up to $4.62 million non-brokered private placement of common shares and flow-through shares

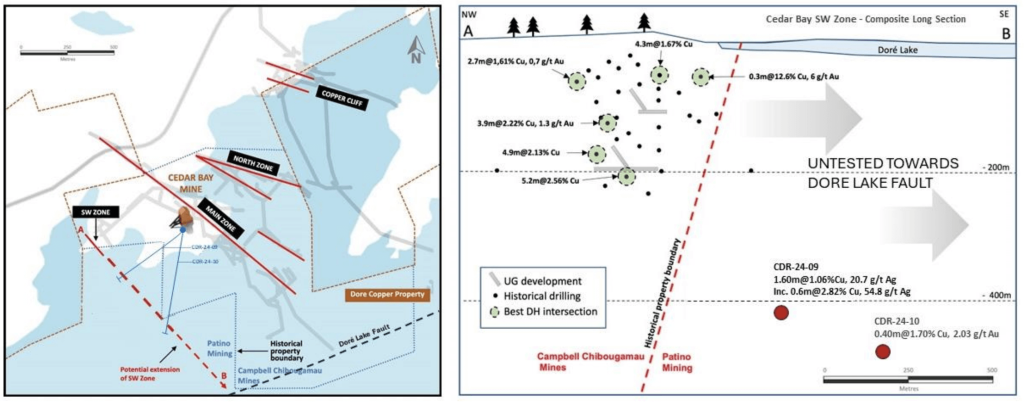

- 2024-07-24 Dore Copper confirms copper mineralization on its Cedar Bay Southwest Extension

- 2024-07-03 Dore Copper enters into an Agreement to acquire claims next to its flagship Corner Bay High-Grade Copper deposit

- 2024-06-20 Dore Copper announces 2024 annual and special meeting results

- 2024-04-19 Dore Copper announces grant of stock options and deferred share units

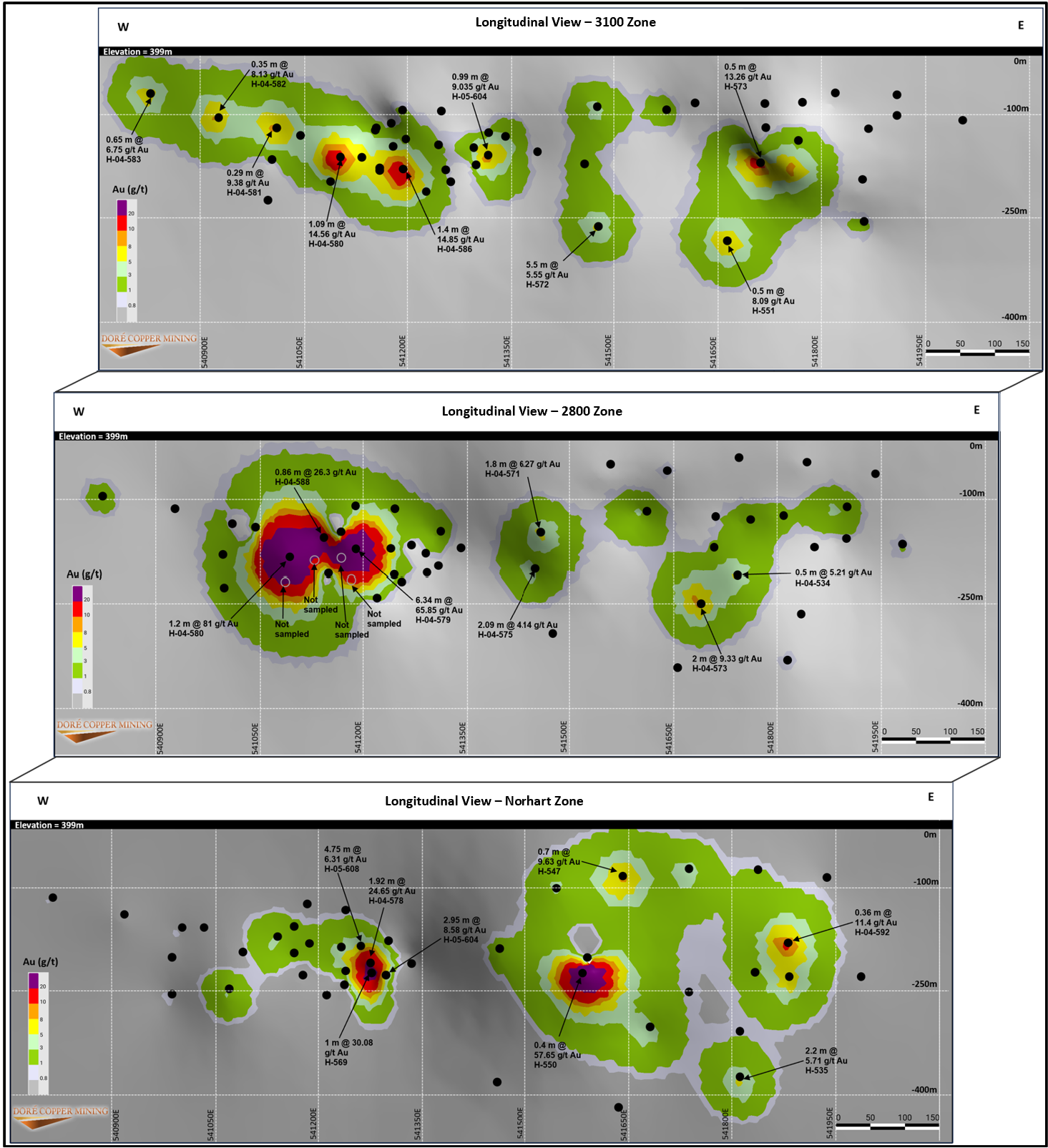

- 2024-03-27 Dore Copper identifies gold exploration potential at Norhart Zone, just North of the former Joe Mann mine

- 2024-02-26 Dore Copper announces Management changes

- 2024-01-22 Doré Copper increases size of its Joe Mann Property by acquiring a 65% interest in 3,030 hectares

- 2024-01-02 Doré Copper announces closing of rights offering

- 2023-11-21 Doré Copper announces rights offering

- 2023-10-30 Dore Copper reports excellent concentrate grades and recoveries with low impurity element concentrations from flotation tests at its Corner Bay project

- 2023-10-17 Doré Copper reports exploration drill results – intersects shallow mineralization grading 4.4 g/t Au over 9.8 metres at Gwillim