Toronto, Ontario – November 18, 2022 – Doré Copper Mining Corp. (the “Company” or “Doré Copper“) (TSXV: DCMC; OTCQX: DRCMF; FRA: DCM) is pleased to announce that it has entered into an agreement (the “Amending Agreement“) on October 28, 2022 to amend the earn-in option agreement (the “Option Agreement“) dated January 2, 2020 between the Company and Ressources Jessie Inc. (“Ressources Jessie“) pursuant to which the Company has an option to acquire the Joe Mann Property (the “Property“) from Ressources Jessie, as previously announced on January 2, 2020. The Joe Mann mine, located 60 kilometers south of Chibougamau, Quebec, produced 1.12 million ounces of gold at an average grade of 8.26 g/t from the 1950s to 20071. The deposit has an inferred resource of 680,000 tonnes grading 6.78 g/t Au and 0.24% Cu, which was included in the Company’s Preliminary Economic Assessment (PEA) of its hub-and-spoke operation announced on May 10, 20222.

Pursuant to the terms of the Amending Agreement, the Company has agreed to accelerate the final scheduled cash and share payments under the Option Agreement. The Company has made the final scheduled cash payment of $1,500,000 to Ressources Jessie (thus fulfilling the scheduled cash payment obligations), and will issue 3,333,333 common shares in the capital of the Company (“Common Shares“) to Legault Metals Inc. (“Legault“) at a deemed price of $0.30 per Common Share for an aggregate value of $1,000,000 upon acceptance of the TSX Venture Exchange (thus fulfilling all scheduled share payment obligations). The deadline for the Company to incur the remaining exploration expenditures on the Property, totaling approximately $830,000, has also been extended to February 28, 2023.

Following the fulfillment of the scheduled cash and share payment obligations, Ressources Jessie will commence the transfer of the Property to the Company. Upon exercise of the option, the Company is required to grant to Ressources Jessie a 2% net smelter return (“NSR“) royalty on the mine production from the Property. The Company will be entitled to buy back 1% NSR in consideration for a payment to Ressources Jessie of $2,000,000 and to buy back an additional 0.5% NSR in consideration for a payment to Ressources Jessie of $4,000,000.

Pursuant to the original terms of the Option Agreement, upon the commencement of commercial production at the Property, Doré Copper will make an additional $1,000,000 cash payment to Ressources Jessie and issue $1,500,000 in Common Shares to Legault.

The Company is currently drilling a hole on the eastern side of the Joe Mann mine, below the deepest mined level, to test the down plunge extension of a historical underground hole that returned 9.33 g/t Au over 2.4 meters (U-9161_D). In early 2023, the Company plans to test a geophysical anomaly located approximately 500 metres south of the mine.

Sylvain Lépine, M.Sc., P.Geo., Vice President Exploration of the Company and a “Qualified Person” within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information contained in this news release.

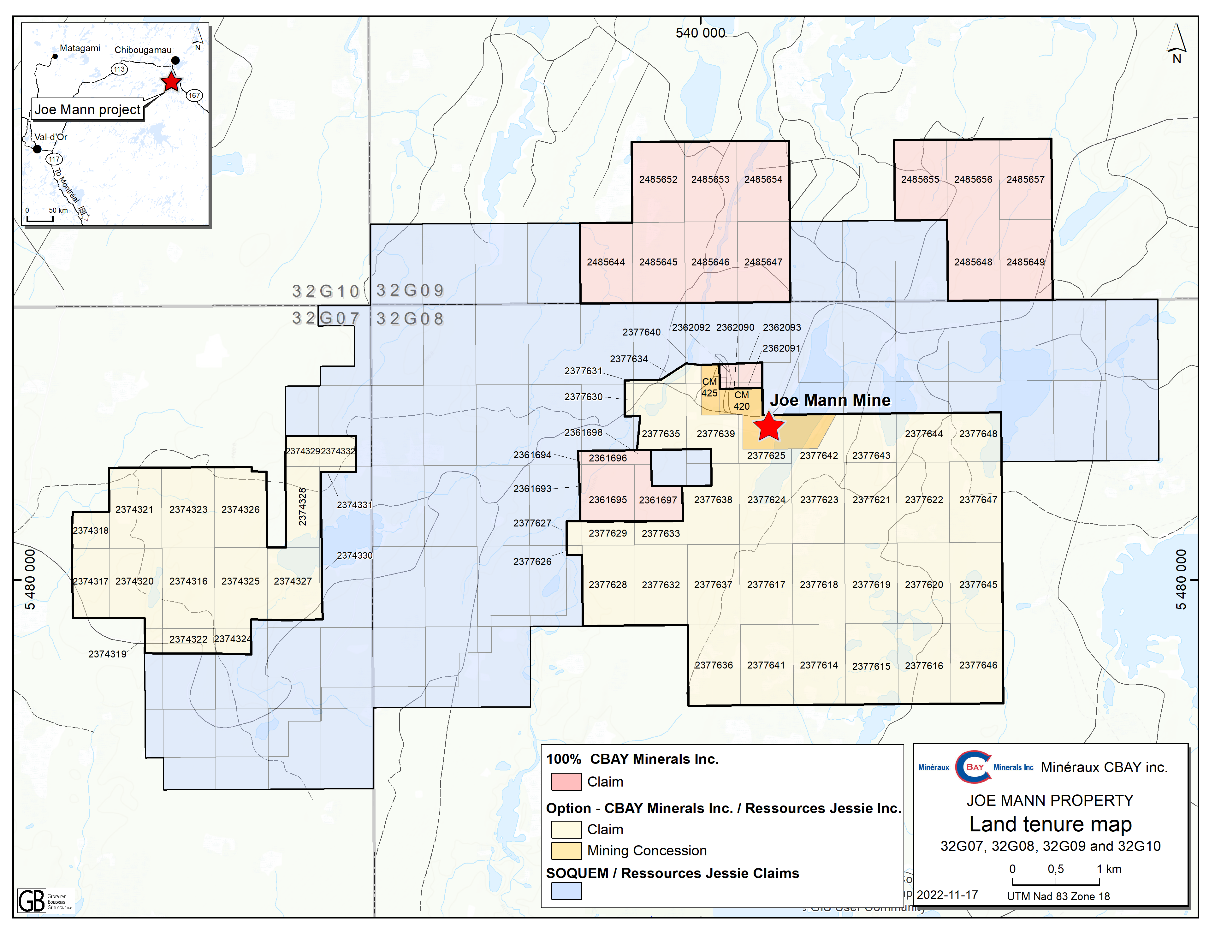

The map below shows the land tenure of the Joe Mann Property.

About Doré Copper Mining Corp.

Doré Copper Mining Corp. aims to be the next copper producer in Québec with an initial production target of +50 Mlbs of copper equivalent annually by implementing a hub-and-spoke operation model with multiple high-grade copper-gold assets feeding its centralized Copper Rand mill2. The Company has delivered its PEA in May 2022 and is proceeding with a feasibility study.

The Company has consolidated a large land package in the prolific Lac Doré/Chibougamau and Joe Mann mining camps that has historically produced 1.6 billion pounds of copper and 4.4 million ounces of gold1. The land package includes 13 former producing mines, deposits and resource target areas within a 60-kilometre radius of the Company’s Copper Rand Mill.

For more information, please visit: www.dorecopper.com

Facebook: Doré Copper Mining

LinkedIn: Doré Copper Mining Corp.

Twitter: @DoreCopper

Instagram: @DoreCopperMining

- Technical report titled “Preliminary Economic Assessment for the Chibougamau Hub-and-Spoke Complex, Québec, Canada” dated June 15, 2022, in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The Technical Report was prepared by BBA Inc. with several consulting firms contributing to sections of the study, including SLR Consulting (Canada) Ltd., SRK Consulting (Canada) Inc. and WSP Inc.

- Sources for historic production figures: Economic Geology, v. 107, pp. 963–989 – Structural and Stratigraphic Controls on Magmatic, Volcanogenic, and Shear Zone-Hosted Mineralization in the Chapais-Chibougamau Mining Camp, Northeastern Abitibi, Canada by François Leclerc et al. (Lac Dore/Chibougamau mining camp) and NI 43-101 Technical Report on the Joe Mann Property dated January 11, 2016 by Geologica Groupe-Conseil Inc. for Jessie Ressources Inc. (Joe Mann mine).

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian and United States securities legislation. Forward-looking statements include, but are not limited to, statements with respect to the use of proceeds of the Offering, the timing and ability of the Corporation to receive necessary regulatory approvals, including the final acceptance of the Offering from the TSX Venture Exchange, the renunciation to the purchasers of the Flow-Through Shares and timing thereof, the tax treatment of the Flow-Through Shares, the Corporation’s ability to meet its production target, the commencement, timing and completion of a feasibility study, and the plans, operations and prospects of the Corporation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive regulatory approvals; the price of gold and copper; and the results of current exploration. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

- 2024-07-24 Dore Copper confirms copper mineralization on its Cedar Bay Southwest Extension

- 2024-07-03 Dore Copper enters into an Agreement to acquire claims next to its flagship Corner Bay High-Grade Copper deposit

- 2024-06-20 Dore Copper announces 2024 annual and special meeting results

- 2024-04-19 Dore Copper announces grant of stock options and deferred share units

- 2024-03-27 Dore Copper identifies gold exploration potential at Norhart Zone, just North of the former Joe Mann mine

- 2024-02-26 Dore Copper announces Management changes

- 2024-01-22 Doré Copper increases size of its Joe Mann Property by acquiring a 65% interest in 3,030 hectares

- 2024-01-02 Doré Copper announces closing of rights offering

- 2023-11-21 Doré Copper announces rights offering

- 2023-10-30 Dore Copper reports excellent concentrate grades and recoveries with low impurity element concentrations from flotation tests at its Corner Bay project

- 2023-10-17 Doré Copper reports exploration drill results – intersects shallow mineralization grading 4.4 g/t Au over 9.8 metres at Gwillim

- 2023-08-01 Doré Copper provides update on its project activities

- 2023-06-06 Doré Copper announces closing of $2.8 million non-brokered private placement of common shares and flow-through shares

- 2023-05-29 Doré Copper reports High-Grade Gold mineralization at Gwillim including 9.67 g/t au over 5.3 metres