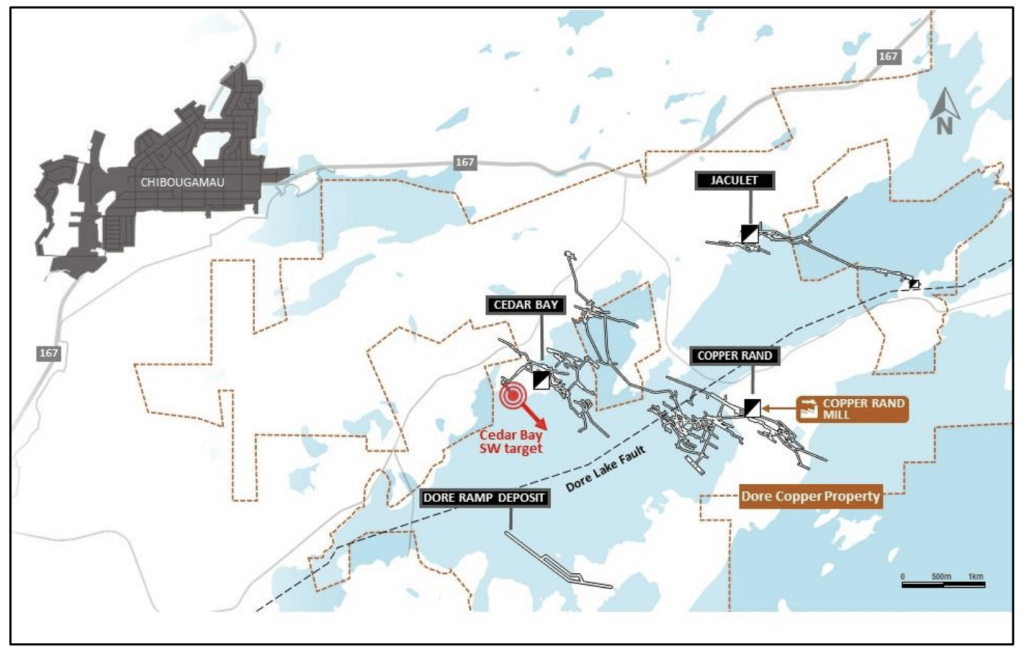

Toronto, Ontario – July 24, 2024 – Doré Copper Mining Corp. (the “Company” or “Doré Copper“) (TSXV: DCMC; OTCQB: DRCMF; FRA: DCM) completed two drill holes totaling 1,392 meters which successfully extended the Southwest Zone of the former Cedar Bay copper-gold mine located in the Chibougamau mining camp, approximately 5 kilometers by road from its Copper Rand mill.

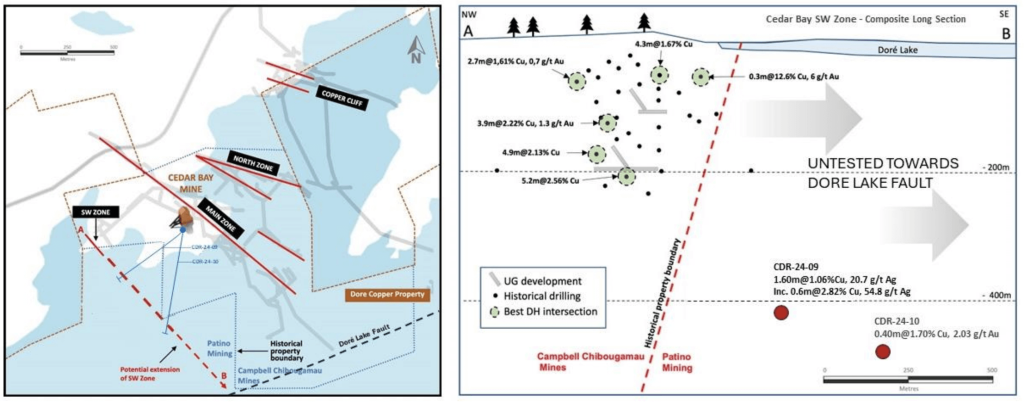

The Southwest Zone is located 300 meters to the southwest of the Cedar Bay mine Main Zone and was partially developed in late 1960s by Campbell Chibougamau Mines Limited (“Campbell”) on two levels (114 meters and 200 meters) right to the property limit with Patino Mining. The best results of Campbell’s drilling campaign in the Southwest Zone included 5.2 meters of 2.56% Cu and 3.9 meters of 2.22% Cu and 1.3 g/t Au1. The potential extension of the Cedar Bay Southwest Zone along strike to the southeast was never tested by Patino Mining and subsequent companies that controlled that ground. In total, approximately 1,080 meters of strike length had not been tested up to the Lac Doré Fault.

The two drill holes completed by Doré Copper targeting the Southwest Zone to the southeast intersected two zones of copper mineralization within strong ductile shear zones with intense hydrothermal alteration. Hole CDR-24-09 intersected 1.6 meters of 1.06% Cu and 20.7 g/t Ag, including 0.6 meter of 2.82% Cu, 54.8 g/t Ag and 0.33 g/t Au, at a vertical depth of 414 meters. The mineralized intersection is characterized by strong pervasive carbonate-chlorite-sericite alteration with banded semi-massive chalcopyrite and pyrrhotite associated with quartz veinlets. Hole CDR-24-10 intersected a wide shear structure of +130 meters (true width) characterized by pervasive black chlorite and carbonate veining alteration starting at a vertical depth of 449 meters. Copper mineralization was intersected at a vertical depth of 541 meters with 0.40 meter of 1.70% Cu and 2.03 g/t Au, characterized by chalcopyrite disseminations and blebs in a discontinuous massive iron oxide band. The strong alteration footprint intersected in hole CDR-24-10 in the anorthosite to gabbroic rocks is characteristic of the Doré Lake Complex magmatic-hydrothermal system and is interpreted to be an indicator of proximity to mineralized ore bodies of the Cu-Au central mining camp.

The Company plans to conduct downhole geophysics to locate stronger conductors near and along the structure as the first hole may not have crossed it. The strong alteration footprint intersected in the second hole is promising as it indicates approximately 400 meters of strike length untested towards the Doré Lake Fault.

Doré Copper received a grant from the Government of Québec of approximately C$182,000 towards the drilling program and geometallurgical characterization. The grant has been offered under the Mineral Exploration Support Program for Critical and Strategic Minerals (Programme de soutien à l’exploration minière pour les minéraux critiques et stratégiques 20212024 or PSEM-MCS), which is overseen by the Ministry of Natural Resources and Forests (Ministère des Ressources naturelles et des Forêts or MRNF).

Ernest Mast, President and CEO of Doré Copper, commented, “We have confirmed the extension of the Cedar Bay Southwest structure towards the Lac Doré fault in two drill holes, including 1.6 meters of 1.06% Cu and 20.7 g/t Ag. We are very excited by the strong alteration in a wide shear zone characteristic of the large copper-gold ore bodies in the camp, including Doré Copper’s Copper Rand and Cedar Bay mines. The next step is to conduct a downhole geophysical survey (pulse EM) to identify the potential for larger mineralized zones along the structure followed by additional drilling. We would also like to thank the Government of Québec for exploration grant and their support to develop the critical and strategic minerals industry within the province.”

Cedar Bay Mine

The Cedar Bay mine operated from 1958 to 1990 and produced 3.9 million tonnes grading 1.56% Cu and 3.22 g/t Au2. The ore from the mine was processed at the Copper Rand mill located 5 kilometers by road. The deposit was mined to a depth of 670.5 meters and the existing shaft extends to a depth of 1,036 meters.

Doré Copper completed four holes (including wedges) totaling 4,842 meters in 2018 and reported an Indicated resource of 130,000 tonnes at 9.44 g/t Au and 1.55% Cu, and an Inferred resource of 230,000 tonnes at 8.32 g/t Au and 2.13% Cu (effective date of December 31, 2018)3. During 2020, the Corporation completed 9,025 meters of drilling and successfully extended a number of mineralized lenses (the 10-20A and 10-20B).

Table 1. Assays Highlights from the 2024 Drill Program at Cedar Bay SW Extension

| Hole | Azimuth/ Dip | From (m) | To (m) | Width1 (m) | Au (g/t) | Ag (g/t) | Cu (%) | Zone |

|---|---|---|---|---|---|---|---|---|

| CDR-24-09 | 227°/47° | 97.0 | 97.7 | 0.70 | 1.95 | 9.90 | 0.22 | unknown |

| 200.4 | 201.0 | 0.60 | 1.42 | 2.10 | 0.11 | unknown | ||

| 575.3 | 576.9 | 1.60 | 0.12 | 20.68 | 1.06 | SW1 | ||

| Including | 575.7 | 576.3 | 0.60 | 0.33 | 54.80 | 2.82 | SW1 | |

| CDR-24-10 | 190°/47° | 757.2 | 757.6 | 0.40 | 2.03 | 1.50 | 1.70 | SW2 |

| 762.0 | 762.7 | 0.70 | 1.27 | 0.35 | 0.16 | unknown |

Drilling and Quality Control

The Company is using Miikan Drilling as the drilling contractor. Miikan is a joint venture between Chibougamau Diamond Drilling Ltd., the First Nations community of Ouje-Bougoumou and the First Nations community of Mistissini both located in the Eeyou Istchee territory.

Sample (HQ size half core) preparation and fire assay analysis were done at ALS Canada Ltd. (“ALS”) in Val-d’Or, Québec, and ICP multi-elements analysis was done at ALS in Vancouver, B.C. Samples were weighed, dried, crushed to 70% passing 2 mm, split to 250 g, and pulverized to 85% passing 75 microns. Samples are fire assayed for gold (Au) (50 g) and Aqua Regia ICP-AES finish for key elements (Ag, Cu, Mo). Samples assaying >10.0 g/t Au are re-analyzed with a gravimetric finish using a 50 g charge.

QA/QC is done in house by Doré Copper geologists with oversight from the Senior Geologist. The check samples (blanks and standards – 4% of total samples with another 2% of core duplicates taken on half split core) that were inserted into the sample batches are verified against their certified values and are deemed a pass if they are within 3 standard deviations of the certified value. The duplicates are evaluated against each other to determine mineralization distribution (nugget). If there are large discrepancies in the check samples, then the entire batch is requested to be re-assayed.

Youssouf Ahmadou, M.Sc., P.Geo., Senior Exploration Geologist of the Company and a QP within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information contained in this news release.

The Qualified Person (“QP”) for the Company has not verified the historical sample analytical data disclosed within this release. While the Company has obtained all historic records including analytical data from the previous owners of the Property and from various government databases, the Company has not independently verified the results of the historic sampling.

About Doré Copper Mining Corp.

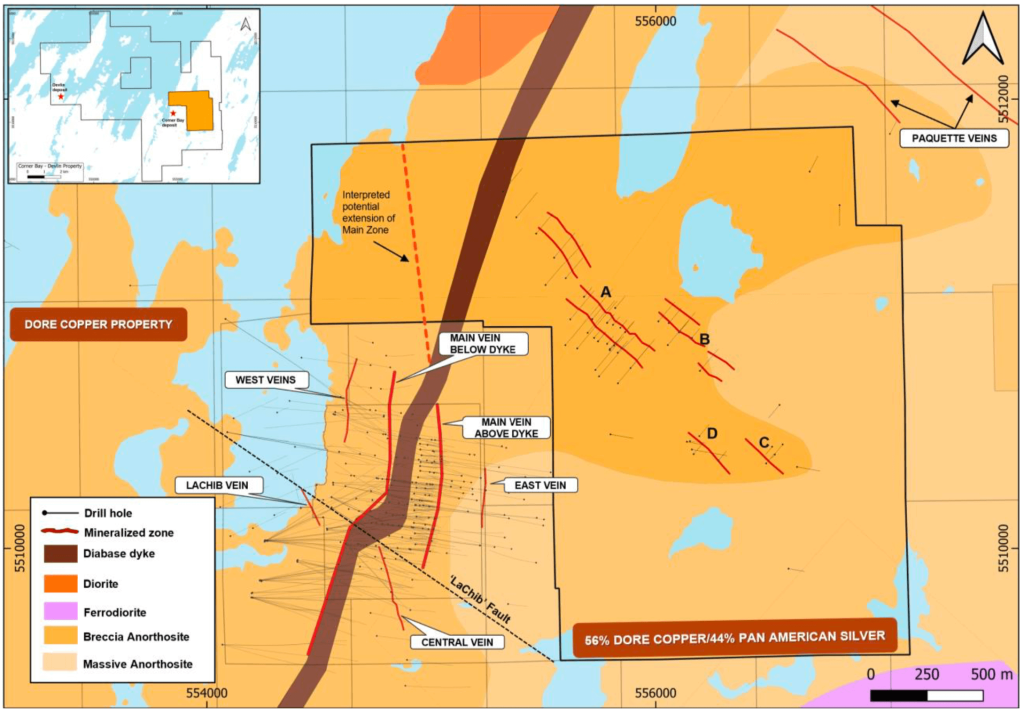

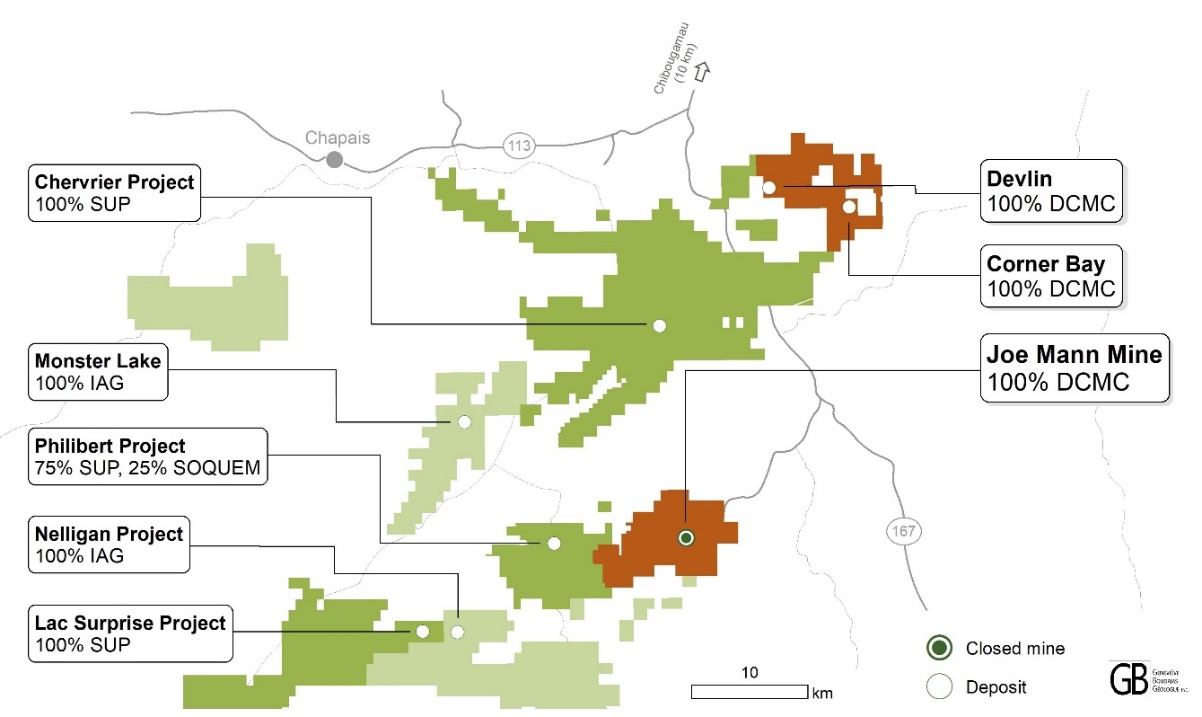

Doré Copper Mining Corp. aims to be the next copper producer in Québec with an initial production target of +50 Mlbs of copper equivalent annually by implementing a hub-and-spoke operation model with multiple high-grade copper-gold assets feeding its centralized Copper Rand mill3.The Company has delivered its PEA in May 2022 and is proceeding with a feasibility study.

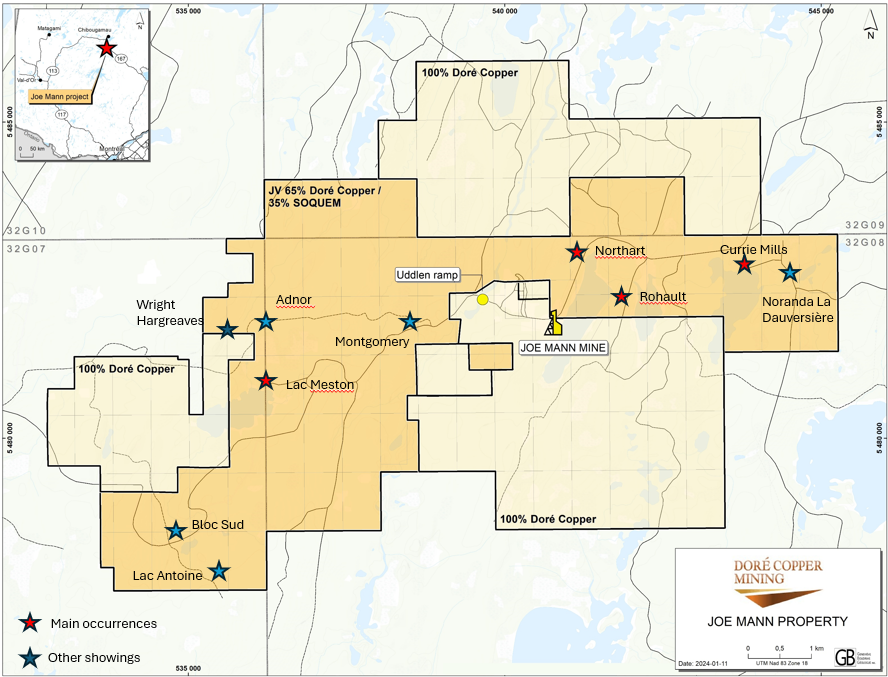

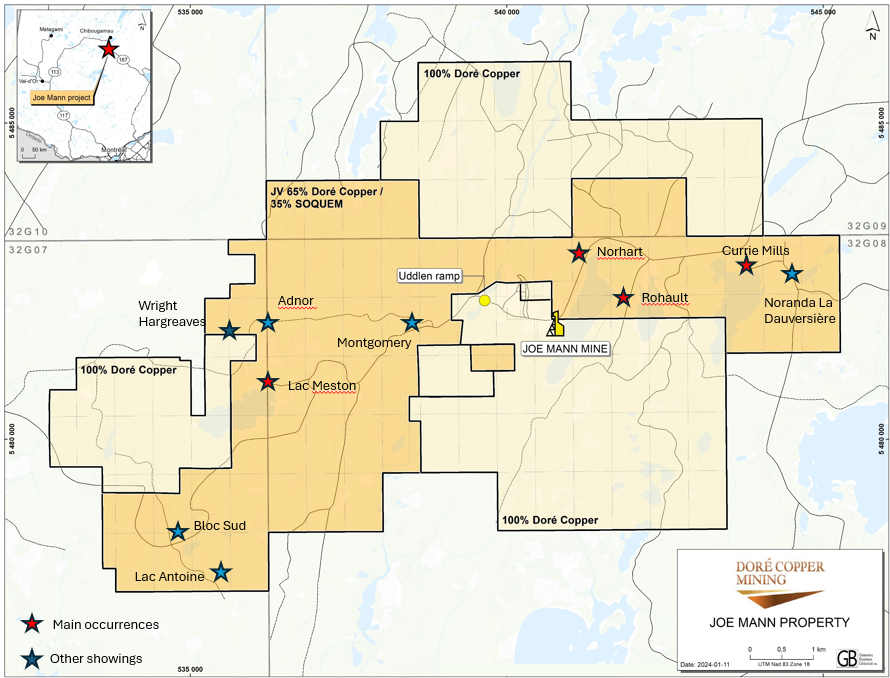

The Company has consolidated a large land package in the prolific Lac Doré/Chibougamau and Joe Mann mining camps that has historically produced 1.6 billion pounds of copper and 4.4 million ounces of gold2.The land package includes 13 former producing mines, deposits and resource target areas within a 60-kilometre radius of the Company’s Copper Rand Mill.

For further information, please contact:

Ernest Mast

President and Chief Executive Officer

Phone: (416) 792-2229

Email:

Laurie Gaborit

VP Investor Relations

Phone: (416) 219-2049

Email:

For more information, please visit: www.dorecopper.com

Facebook: Doré Copper Mining

LinkedIn: Doré Copper Mining Corp.

Twitter: @DoreCopper

Instagram: @DoreCopperMining

- Reference: Bunkhouse zone (Cedar Bay SW) Longitudinal section (Campbell Chibougamau Mines Ltd 1976).

- Sources for historic production figures: Economic Geology, v. 107, pp. 963–989 – Structural and Stratigraphic Controls on Magmatic, Volcanogenic, and Shear Zone-Hosted Mineralization in the Chapais-Chibougamau Mining Camp, Northeastern Abitibi, Canada by François Leclerc et al. (Lac Dore/Chibougamau mining camp) and NI 43-101 Technical Report on the Joe Mann Property dated January 11, 2016 by Geologica Groupe-Conseil Inc. for Jessie Ressources Inc. (Joe Mann mine).

- Technical report titled “Preliminary Economic Assessment for the Chibougamau Hub-and-Spoke Complex, Québec, Canada” dated June 15, 2022, in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects. The Technical Report was prepared by BBA Inc. with several consulting firms contributing to sections of the study, including SLR Consulting (Canada) Ltd., SRK Consulting (Canada) Inc. and WSP Inc.

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this news release, including, without limitation, statements with respect to the timing and ability of the Company to receive necessary regulatory approvals, the Company’s ability to meet its production target, the commencement, timing and completion of a feasibility study, and the plans, operations and prospects of the Company and its properties are forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to, actual exploration results, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required regulatory approvals, health emergencies, pandemics and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

- 2024-07-24 Dore Copper confirms copper mineralization on its Cedar Bay Southwest Extension

- 2024-07-03 Dore Copper enters into an Agreement to acquire claims next to its flagship Corner Bay High-Grade Copper deposit

- 2024-06-20 Dore Copper announces 2024 annual and special meeting results

- 2024-04-19 Dore Copper announces grant of stock options and deferred share units

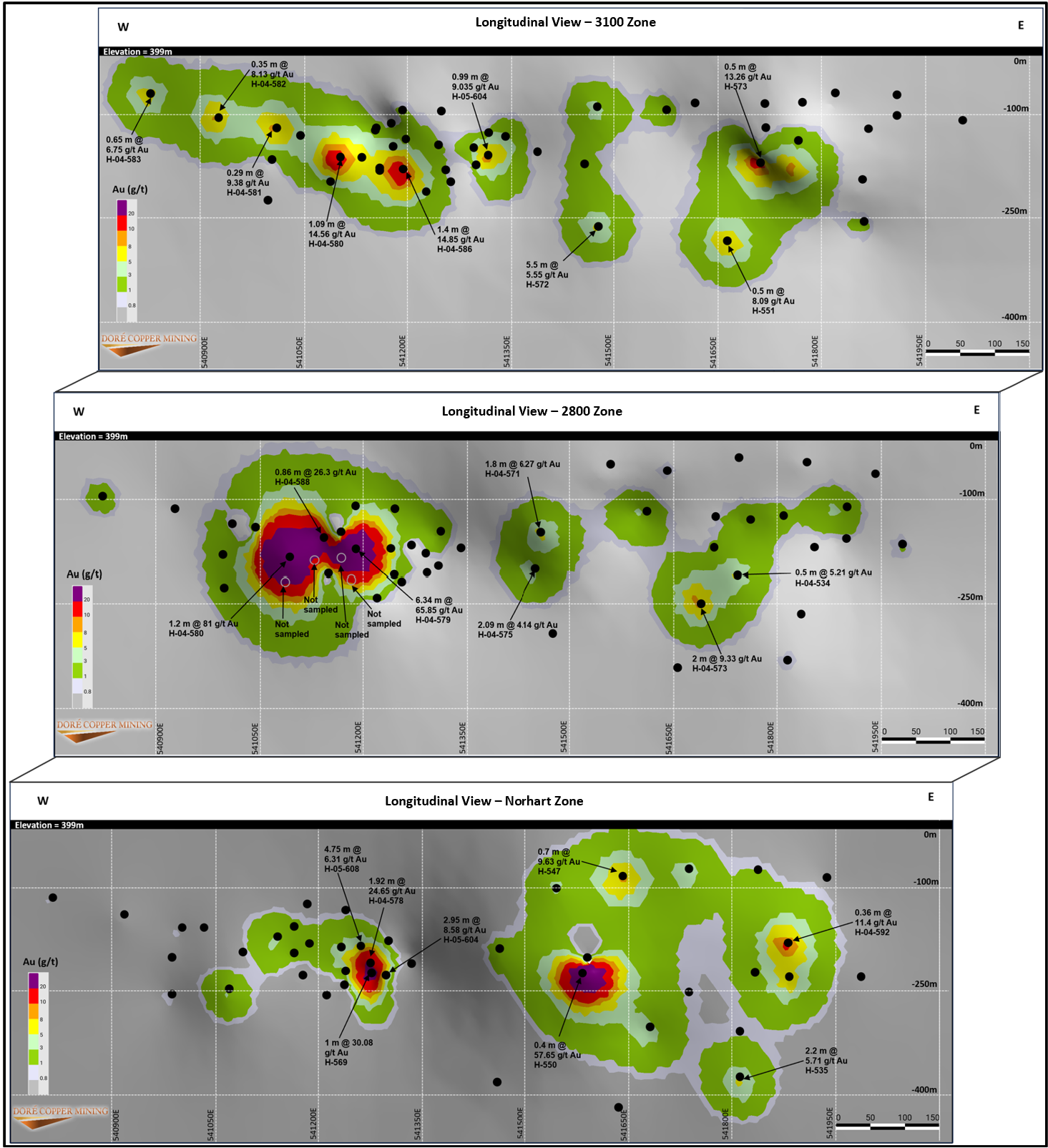

- 2024-03-27 Dore Copper identifies gold exploration potential at Norhart Zone, just North of the former Joe Mann mine

- 2024-02-26 Dore Copper announces Management changes

- 2024-01-22 Doré Copper increases size of its Joe Mann Property by acquiring a 65% interest in 3,030 hectares

- 2024-01-02 Doré Copper announces closing of rights offering

- 2023-11-21 Doré Copper announces rights offering

- 2023-10-30 Dore Copper reports excellent concentrate grades and recoveries with low impurity element concentrations from flotation tests at its Corner Bay project

- 2023-10-17 Doré Copper reports exploration drill results – intersects shallow mineralization grading 4.4 g/t Au over 9.8 metres at Gwillim

- 2023-08-01 Doré Copper provides update on its project activities

- 2023-06-06 Doré Copper announces closing of $2.8 million non-brokered private placement of common shares and flow-through shares

- 2023-05-29 Doré Copper reports High-Grade Gold mineralization at Gwillim including 9.67 g/t au over 5.3 metres