Not for distribution to United States news wire services or for dissemination in the United States

Toronto, Ontario – February 18, 2021 – Doré Copper Mining Corp. (the “Corporation” or “Doré Copper“) (TSXV: DCMC; OTCQB: DRCMF; FRA: DCM) is pleased to announce that it has closed its previously announced “best efforts” private placement (the “Offering“), pursuant to which the Corporation sold an aggregate of 12,221,000 common shares of the Corporation that will qualify as “flow-through shares” within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the “Flow-Through Shares“) at a price of C$0.90 per Flow-Through Share for aggregate gross proceeds of C$10,998,900, including the full exercise of the agents’ option. With the closing of this Offering, the Corporation now has 53,158,668 common shares outstanding.

Ernest Mast, President and CEO, stated: “With this funding, Doré Copper’s cash balance totals approximately C$16 million, providing ample funds for the Corporation to continue exploration and advance its key high-grade copper-gold projects in Chibougamau, Québec to a PEA (Preliminary Economic Assessment) later this year that envisions a hub-and-spoke operation feeding a centralized mill. We are also pleased to announce that several established mining entrepreneurs were involved in the Offering, resulting in a meaningful share position in the Corporation. These investors have indicated that they share the Corporation’s vision of building a new and significant Canadian-based copper-gold mining company and will help in providing strategic advice to the Corporation in achieving that vision.”

Cormark Securities Inc. and Paradigm Capital Inc. acted as agents (the “Agents“) in connection with the Offering pursuant to the terms of an agency agreement dated February 18, 2021. In consideration for their services in connection with the Offering, the Corporation paid the Agents a cash commission equal to $659,934 representing 6% of the aggregate gross proceeds from the sale of Flow-Through Shares.

The Corporation will use an amount equal to the gross proceeds received by the Corporation from the sale of the Flow-Through Shares, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible “Canadian exploration expenses” that qualify as “flow-through mining expenditures” as both terms are defined in the IncomeTaxAct(Canada) (the “QualifyingExpenditures“) on or before December 31, 2022, and will renounce all of the Qualifying Expenditures in favour of the purchasers of the Flow-Through Shares effective December 31, 2021. The Corporation will shortly announce its drilling plans for the next two quarters based on the funds available from the recent financings.

The Offering was made by way of private placement in Canada pursuant to applicable exemptions from the prospectus requirements under applicable Canadian securities laws. The securities issued under the Offering are subject to a hold period under applicable Canadian securities laws which will expire on June 19, 2021. The Offering is subject to final acceptance of the TSX Venture Exchange.

The securities offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, or any state securities law, and may not be offered, sold or delivered, directly or indirectly, within the United States, or to or for the account or benefit of U.S. persons, absent registration or an exemption from such registration requirements. This news release does not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of securities in any state in the United States in which such offer, solicitation or sale would be unlawful.

About Doré Copper Mining Corp.

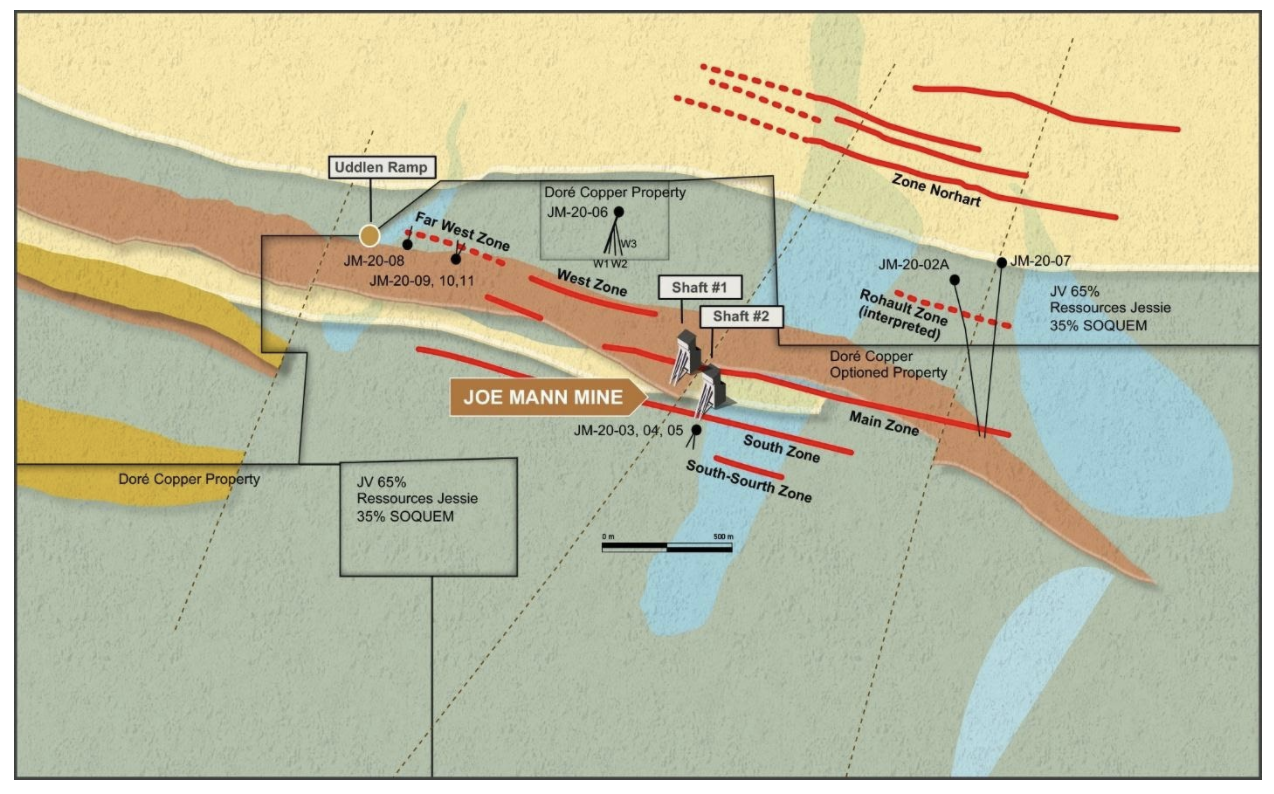

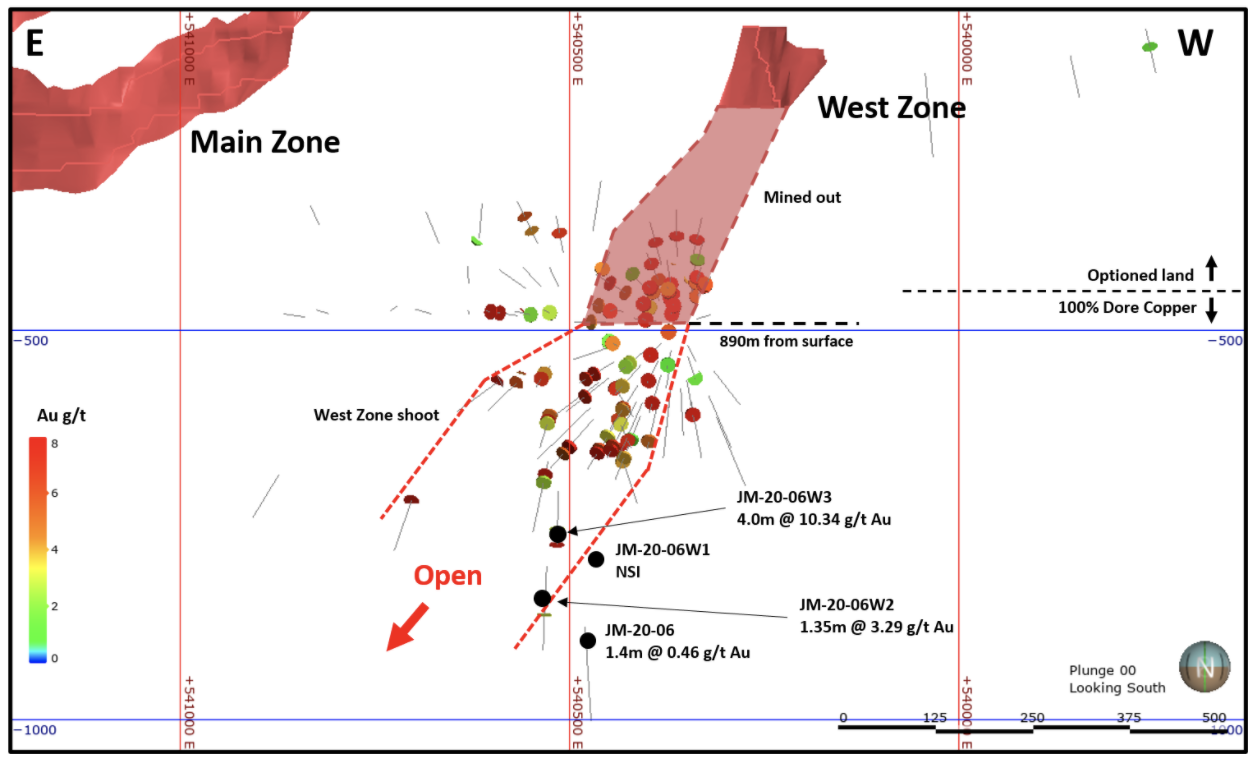

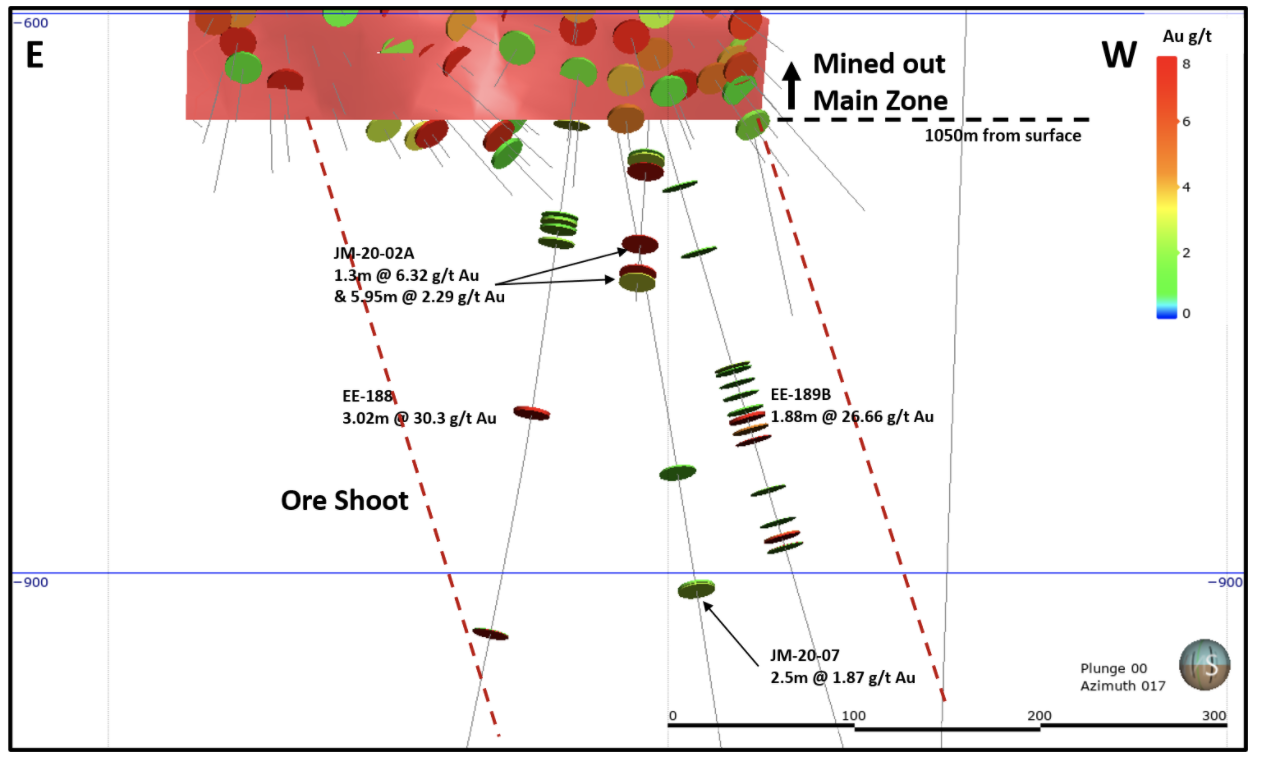

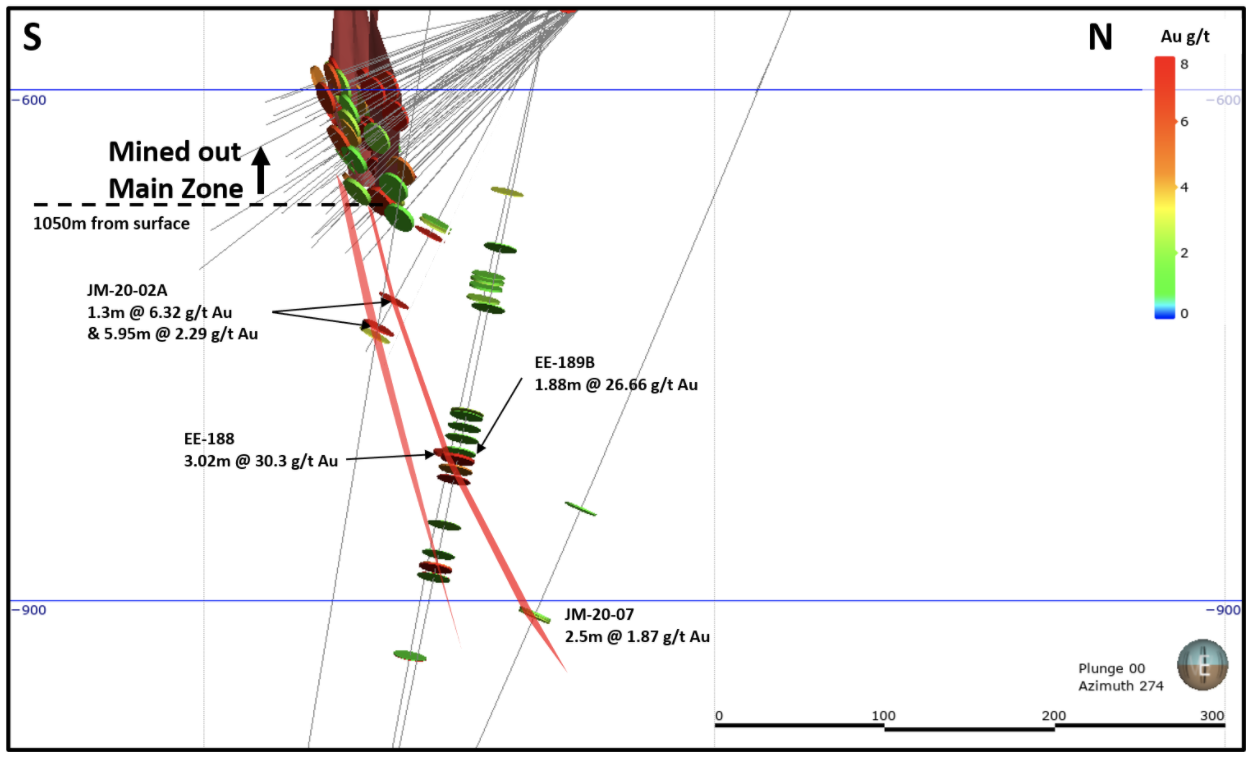

Doré Copper Mining Corp. is a copper-gold explorer and developer in the Chibougamau area of Québec, Canada. Doré Copper has consolidated a large land package in the prolific Lac Doré/Chibougamau mining camp that has historically produced 1.6 B lbs of copper and 3.2 M oz of gold. In addition, the Corporation has optioned the high-grade Joe Mann gold mine (historical production 1.17 M oz at 8.26 g/t Au). The land package includes 12 former producing mines, deposits and resource target areas within a 60 kilometre radius of the Corporation’s 2,700 tpd mill (Copper Rand Mill).

The Corporation’s current focus is to grow mineral resources and re-develop the high-grade Corner Bay (Cu-Au), Cedar Bay (Au-Cu), and Joe Mann (Au) deposits. The Corporation has resumed its drilling program starting at Corner Bay, which will lead to an updated mineral resource estimate in Q2 2021 and a PEA in H2 2021.

For further information, please visit the Corporation’s website at www.dorecopper.com or refer to Doré Copper’s SEDAR filings at www.sedar.com or contact:

Ernest Mast

President and Chief Executive Officer

Phone: (416) 792-2229

Email:

Laurie Gaborit

VP Investor Relations

Phone: (416) 219-2049

Email:

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to the terms of the Offering, the use of proceeds of the Offering, the timing and ability of the Corporation to close a second tranche of the Offering, the timing and ability of the Corporation to receive necessary regulatory approvals, including the final acceptance of the TSX Venture Exchange, and the plans, operations and prospects of the Corporation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive regulatory approvals; the price of gold and copper; and the results of current exploration. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

- 2024-04-19 Dore Copper announces grant of stock options and deferred share units

- 2024-03-27 Dore Copper identifies gold exploration potential at Norhart Zone, just North of the former Joe Mann mine

- 2024-02-26 Dore Copper announces Management changes

- 2024-01-22 Doré Copper increases size of its Joe Mann Property by acquiring a 65% interest in 3,030 hectares

- 2024-01-02 Doré Copper announces closing of rights offering

- 2023-11-21 Doré Copper announces rights offering

- 2023-10-30 Dore Copper reports excellent concentrate grades and recoveries with low impurity element concentrations from flotation tests at its Corner Bay project

- 2023-10-17 Doré Copper reports exploration drill results – intersects shallow mineralization grading 4.4 g/t Au over 9.8 metres at Gwillim

- 2023-08-01 Doré Copper provides update on its project activities

- 2023-06-06 Doré Copper announces closing of $2.8 million non-brokered private placement of common shares and flow-through shares

- 2023-05-29 Doré Copper reports High-Grade Gold mineralization at Gwillim including 9.67 g/t au over 5.3 metres

- 2023-05-15 Dore Copper announces grant of stock options and deferred share units

- 2023-05-08 Doré Copper announces up to $3 million non-brokered private placement of common shares and flow-through shares

- 2023-05-03 Doré Copper to Drill High Priority Copper-Gold Targets This Summer in Chibougamau, Quebec