Toronto, Ontario – June 1, 2021 – Doré Copper Mining Corp. (the “Corporation” or “Doré Copper“) (TSXV: DCMC; OTCQX: DRCMF; FRA: DCM) is pleased to announce today that Steve Simard will be joining the Corporation as Project Director. Mr. Simard’s significant experience will provide technical and management leadership as Doré Copper advances its key projects from exploration stage, through economic studies and execution for operational readiness.

Mr. Simard has over 20 years of domestic and international experience in both surface and underground mine development and operations. He has been involved at various stages of mine construction and optimization, strategic mine plan optimization, and general site infrastructure. He spent the last four years at Semafo’s Mana Mine in Burkina Faso as Technical Superintendent and Mining Operation where he led the mine production, engineering and geology departments. Prior to his Semafo employment, Mr. Simard worked extensively in Québec in progressive technical roles: Chief Engineer and Technical Superintendent at Rio Tinto’s open cast titanium dioxide mine at Lac Tio Mine (2016-17 & 2005-08); Superintendent Technical Services at BlackRock Metals in Chibougamau (2011-16); and Senior Engineer and Chief Engineer at Consolidated Thompson Iron Mine’s Bloom Lake Mine, which produces high-quality iron ore concentrate (2008-11). He started his career as a Long-hole Engineer and Planning Engineer at the Beaufor Mine in Val d’Or.

Ernest Mast, President and CEO of Doré Copper, stated, “On behalf of the Company, I am pleased to welcome Steve Simard to the Doré Copper management team. Based in Chibougamau, his solid broad-based experience, knowledge and leadership skills will play an important role as we progress our key high-grade copper and gold projects to economic studies and re-development stage based on a profitable hub-and spoke operation model.”

About Doré Copper Mining Corp.

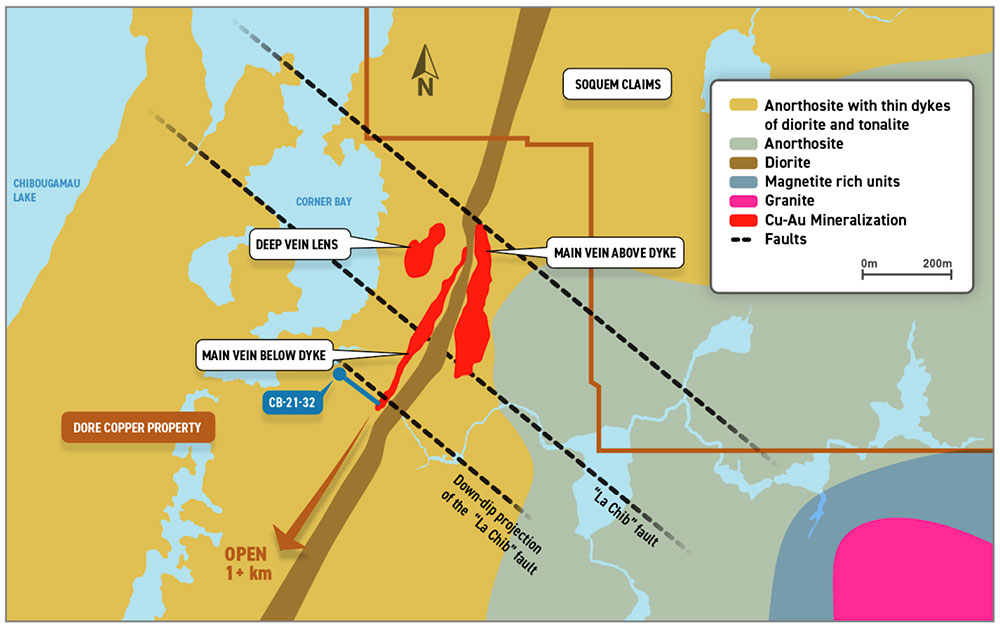

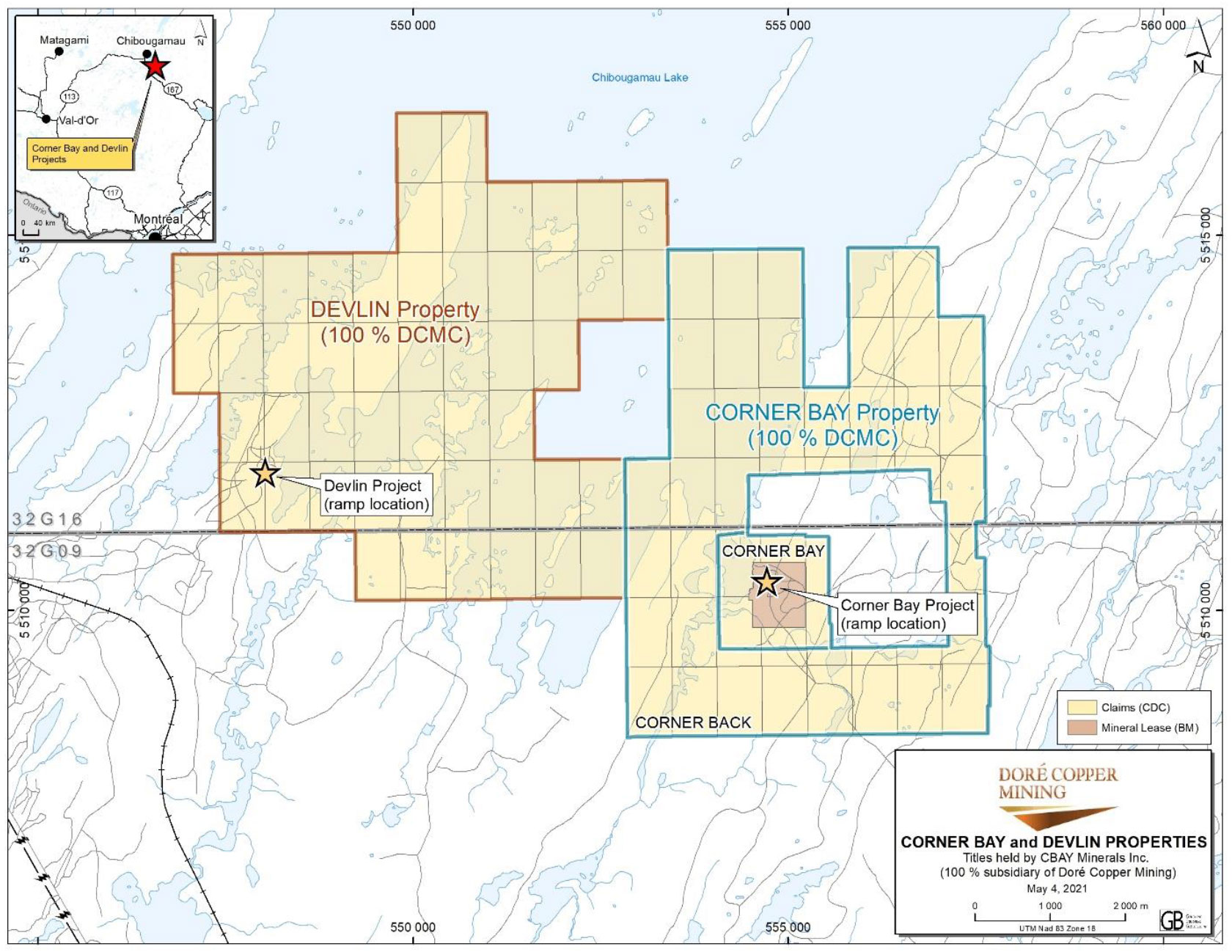

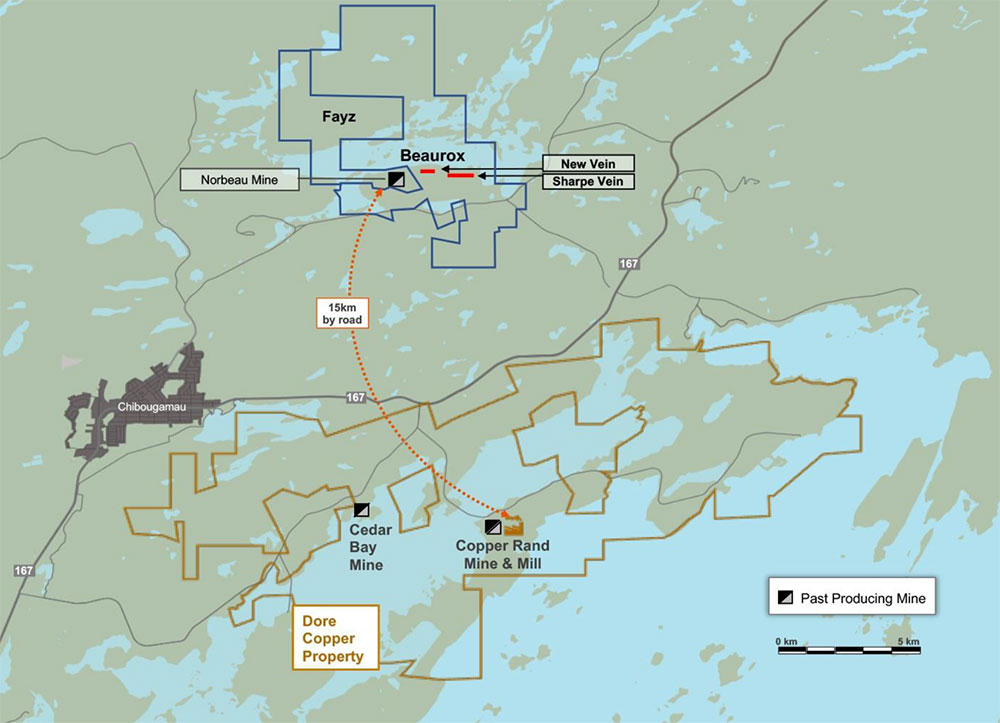

Doré Copper Mining Corp. is a copper-gold explorer and developer in the Chibougamau area of Québec, Canada. The Corporation is focussed on implementing its hub-and-spoke development strategy by advancing its key high-grade copper-gold brownfield projects towards a restart of operations. Our goal is to achieve an annual production of 60 M lbs of copper equivalent (or 100,000 oz gold equivalent).

The Corporation has consolidated a large land package in the prolific Lac Dore/Chibougamau and Joe Mann mining camps that has produced 1.6 B lbs of copper and 4.4 M oz of gold. The land package includes 13 former producing mines, deposits and resource target areas within a 60-kilometre radius of the Company’s 2,700 tpd mill (Copper Rand Mill).

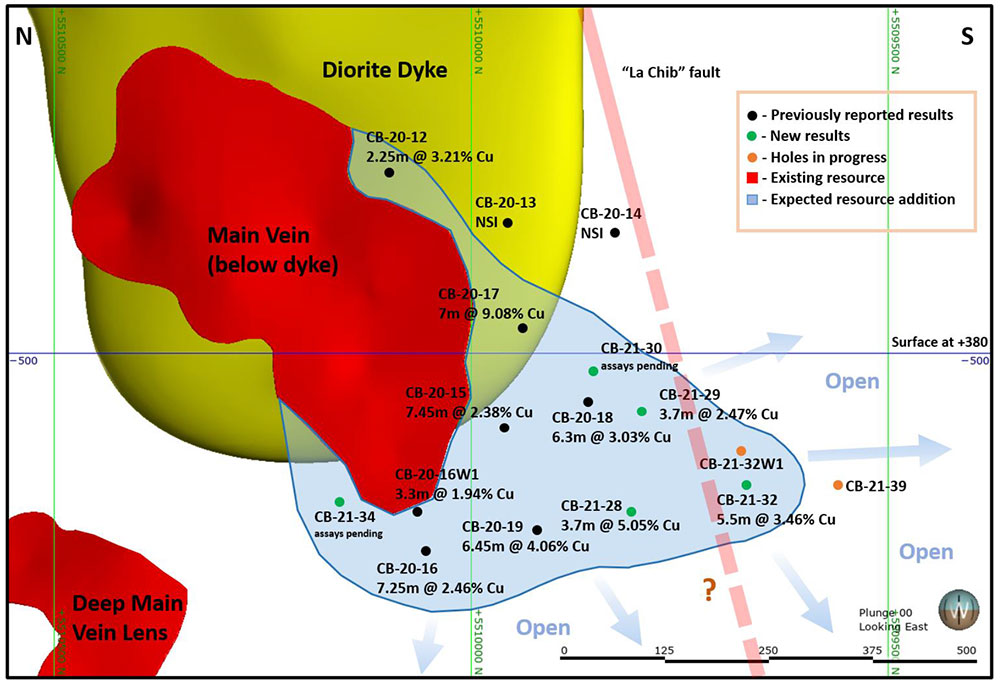

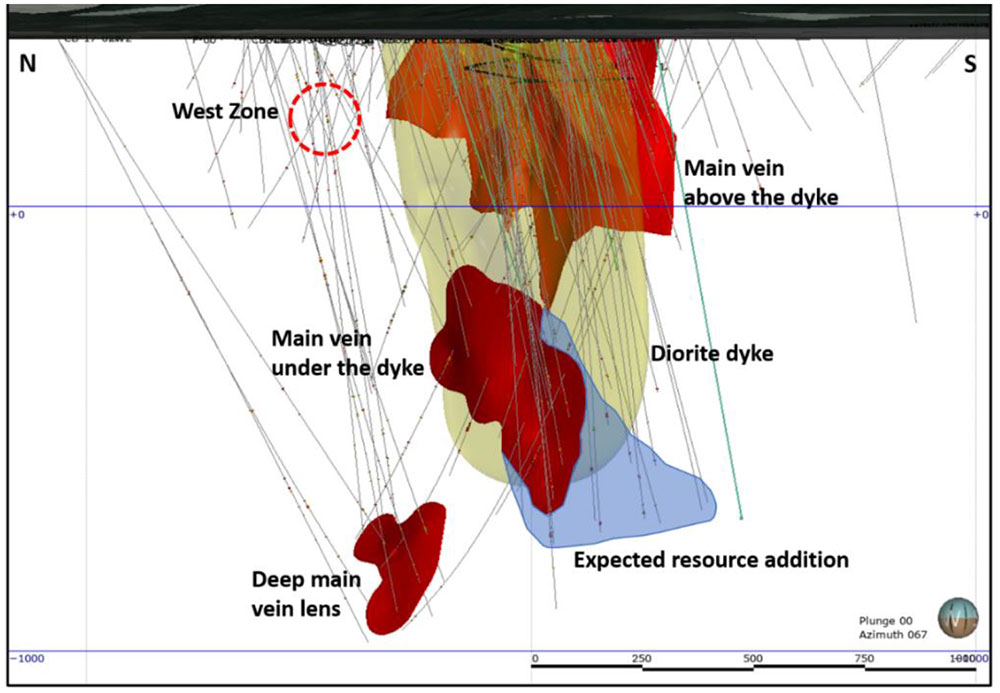

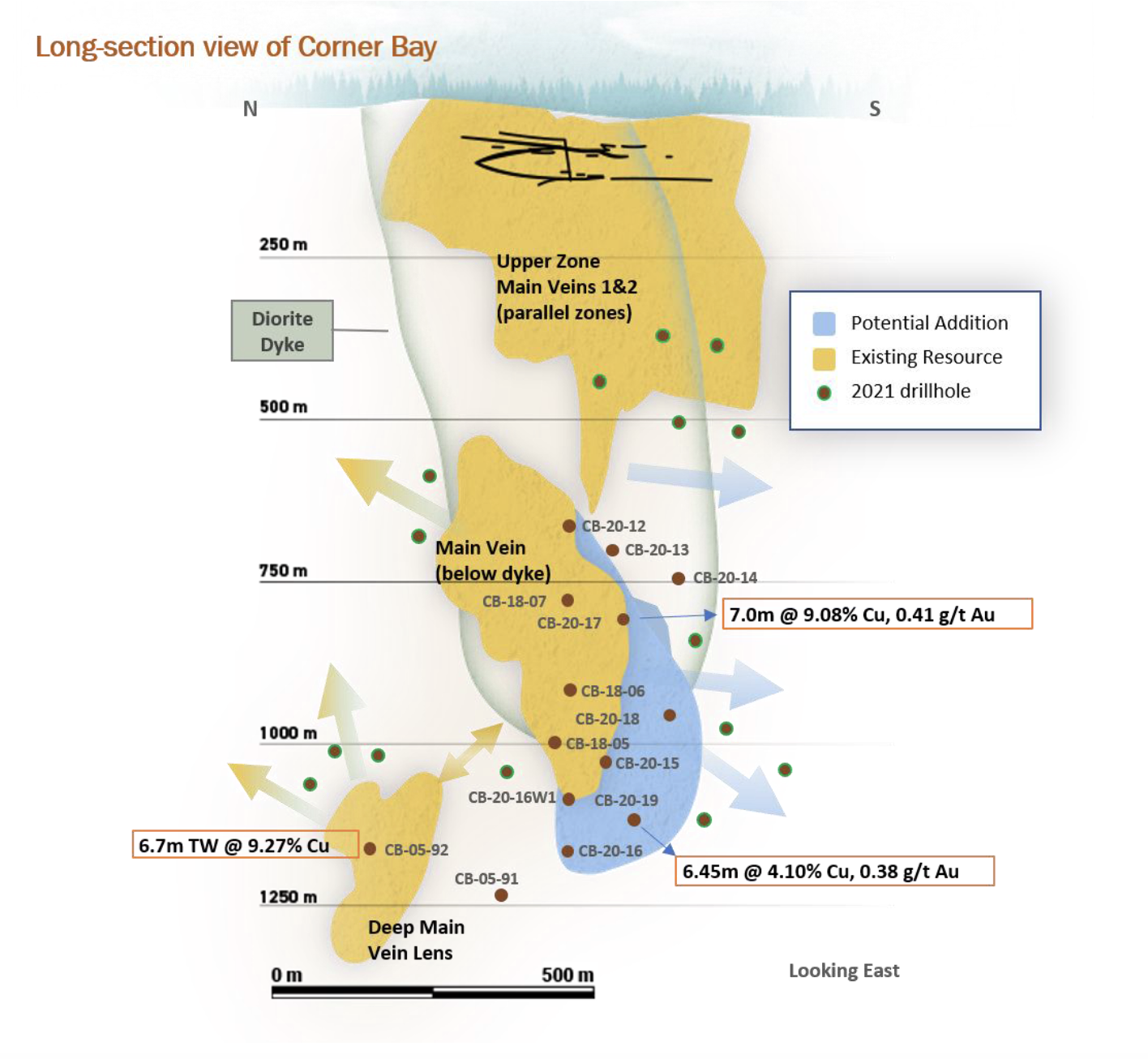

Doré Copper plans to deliver a preliminary economic assessment (PEA) of its hub-and-spoke model in late 2021. Currently, the Corporation is completing a 16,500-metre drilling program at its Corner Bay (Cu-Au) project which will lead to an updated mineral resource estimate in early Q3 2021. In addition, Doré Copper is expected to have a maiden mineral resource estimate for the former producing Joe Mann mine (Au-Cu) by end of June 2021.

For further information, please visit the Corporation’s website at www.dorecopper.com or refer to Doré Copper’s SEDAR filings at www.sedar.com or contact:

Ernest Mast

President and Chief Executive Officer

Phone: (416) 792-2229

Email:

Laurie Gaborit

VP Investor Relations

Phone: (416) 219-2049

Email:

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the timing and ability of the Corporation to receive necessary regulatory approvals, and the plans, operations and prospects of the Corporation and its properties are forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to, actual exploration results, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required regulatory approvals, health emergencies, pandemics and other exploration or other risks detailed herein and from time to time in the filings made by the Corporation with securities regulators. Although the Corporation has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

- 2024-07-24 Dore Copper confirms copper mineralization on its Cedar Bay Southwest Extension

- 2024-07-03 Dore Copper enters into an Agreement to acquire claims next to its flagship Corner Bay High-Grade Copper deposit

- 2024-06-20 Dore Copper announces 2024 annual and special meeting results

- 2024-04-19 Dore Copper announces grant of stock options and deferred share units

- 2024-03-27 Dore Copper identifies gold exploration potential at Norhart Zone, just North of the former Joe Mann mine

- 2024-02-26 Dore Copper announces Management changes

- 2024-01-22 Doré Copper increases size of its Joe Mann Property by acquiring a 65% interest in 3,030 hectares

- 2024-01-02 Doré Copper announces closing of rights offering

- 2023-11-21 Doré Copper announces rights offering

- 2023-10-30 Dore Copper reports excellent concentrate grades and recoveries with low impurity element concentrations from flotation tests at its Corner Bay project

- 2023-10-17 Doré Copper reports exploration drill results – intersects shallow mineralization grading 4.4 g/t Au over 9.8 metres at Gwillim

- 2023-08-01 Doré Copper provides update on its project activities

- 2023-06-06 Doré Copper announces closing of $2.8 million non-brokered private placement of common shares and flow-through shares

- 2023-05-29 Doré Copper reports High-Grade Gold mineralization at Gwillim including 9.67 g/t au over 5.3 metres