Download PDF English | French | GERMAN

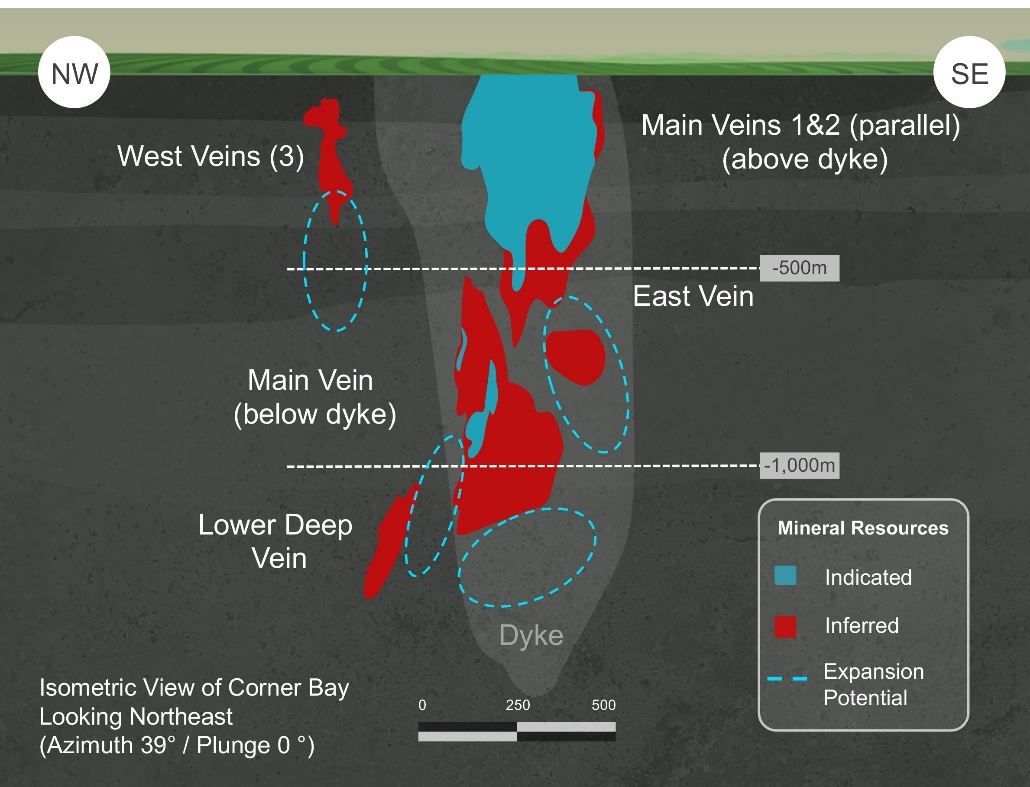

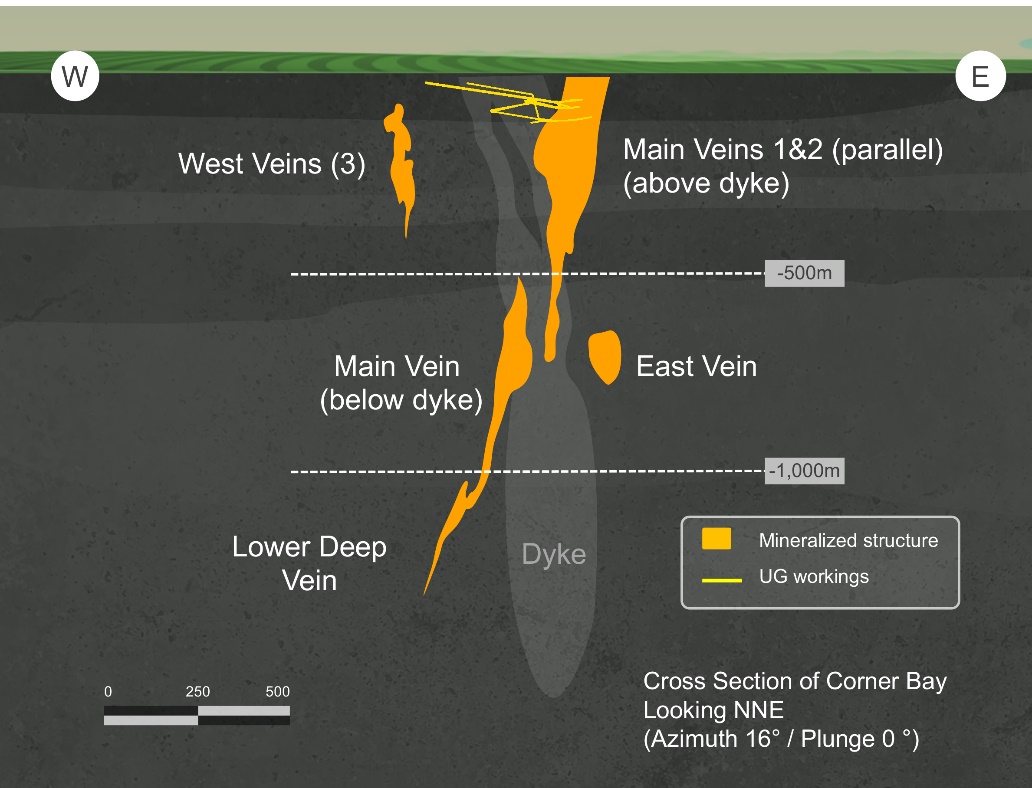

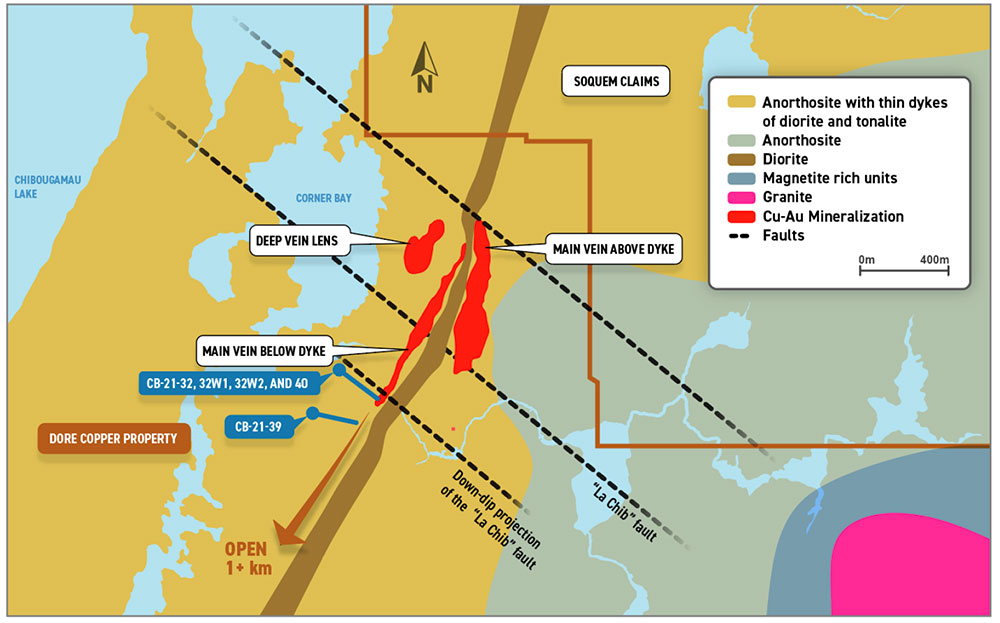

Toronto, Ontario – December 16, 2021 – Doré Copper Mining Corp. (the “Corporation” or “Doré Copper“) (TSXV: DCMC; OTCQX: DRCMF; FRA: DCM) is pleased to announce positive results from recent sample test work aimed at determining the effectiveness of utilizing ore sorting technology to improve the processed grade and reduce the mill feed tonnage for its flagship Corner Bay high-grade copper-gold project located approximately 55 kilometers by road from the Corporation’s Copper Rand mill, near Chibougamau, Québec.

Highlights of Ore Sorting Test

- Sample taken from the development mineralized material stockpiled at surface which was extracted during the preparation of the 2008 bulk sample

- Results indicate that the grade of the pre-concentrate tested with the ore sorter increased 2.6x, from 2.66% Cu to 6.84% Cu, with a recovery of 95.5% Cu by utilizing an X-ray transmission (XRT) sensor at Corem’s test facility in Québec City

- Reject material contained 62.8% of the initial mass and had a copper grade of 0.19%

- In practice, a higher recovery would be expected as fine materials from the mining and crushing operations would join the ore sorter pre-concentrate

- Corner Bay mineralization is amenable to sorting and would have the following cost and environmental benefits:

- Decrease in transportation costs and greenhouse gas emissions (GHGs) due to a reduction of transported material from mine to mill

- Decrease energy consumption at the mill due to the higher feed grade and hardness decrease of the feed material (lower Bond Work Index of the sorter pre-concentrate product compared to the feed)

- Reduce production of fine tailings

- Increase capacity of the mill to treat additional materials

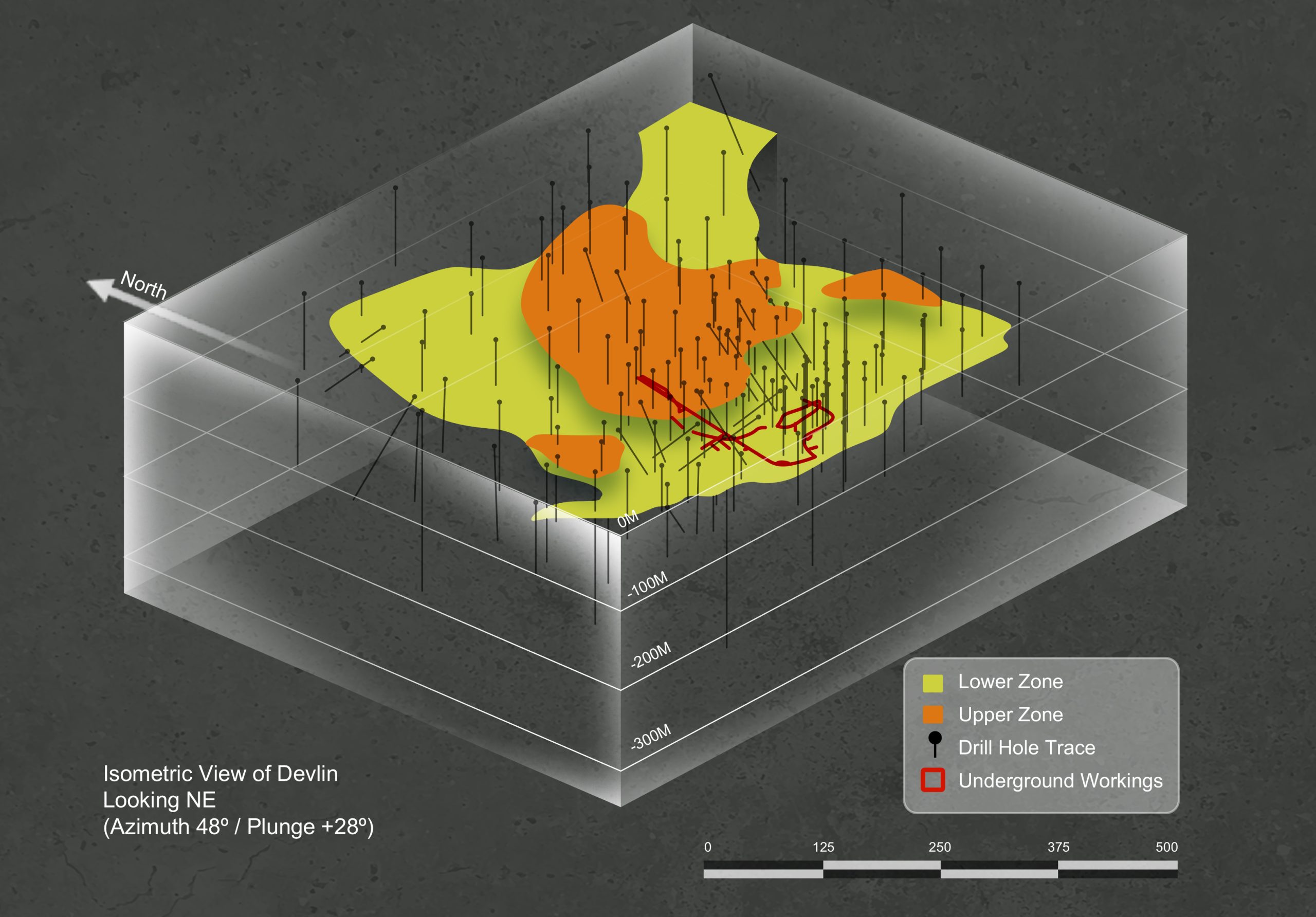

Commenting on the results of our first sorting tests, Ernest Mast, President & CEO, stated, “This initial sorting test is very positive, indicating that the grade of Corner Bay can be significantly upgraded. The upcoming PEA will include a trade-off study on the integration of ore sorting technology for Corner Bay and its potential economic benefits. Based on the historical sorting test work and the nature of the mineralization at the Devlin deposit, our secondary hub-and-spoke asset, we expect that ore sorting could also be successful there. Future development work will include additional ore sorting tests in different areas of the deposits.”

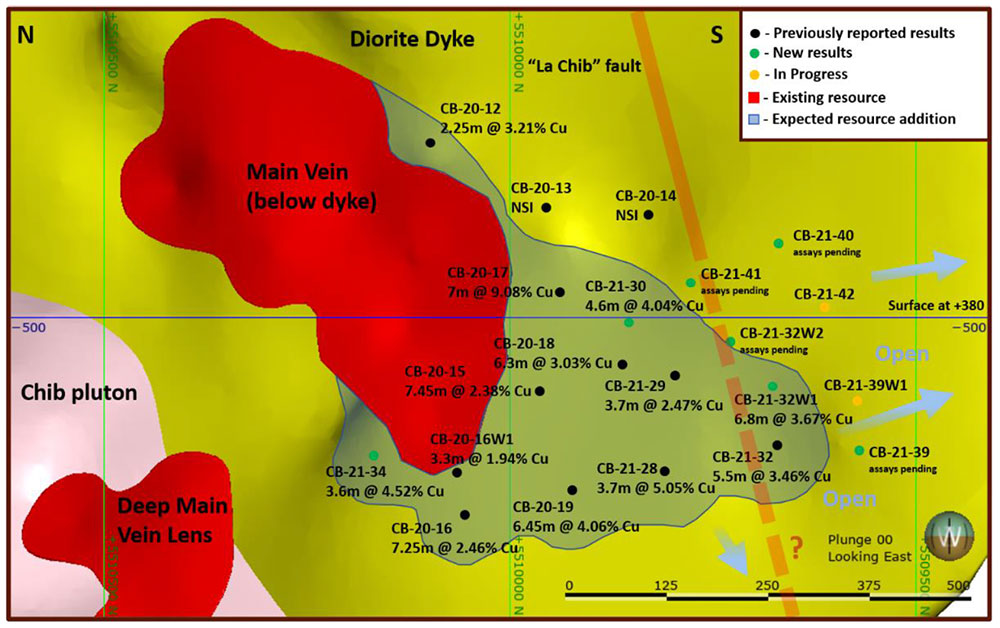

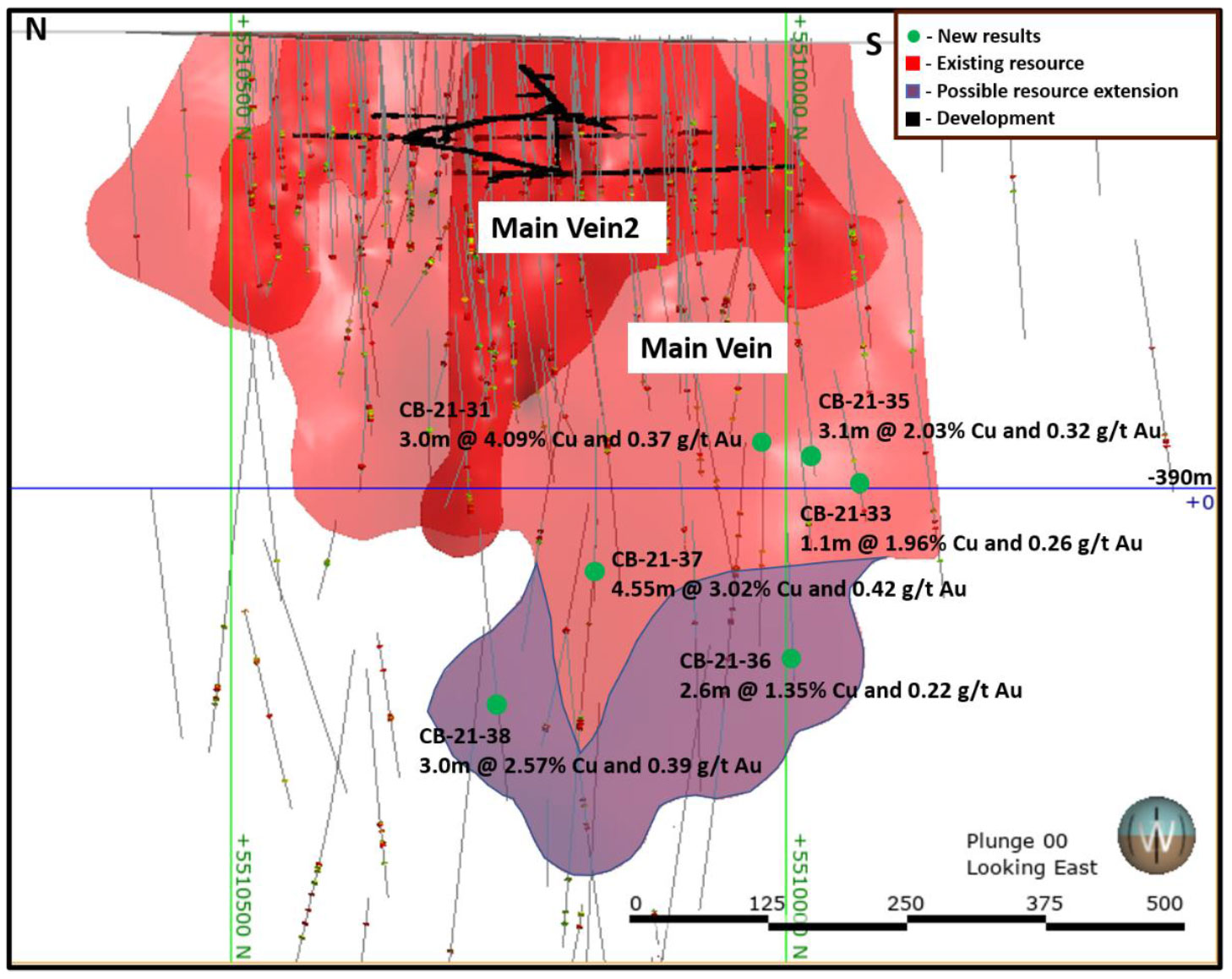

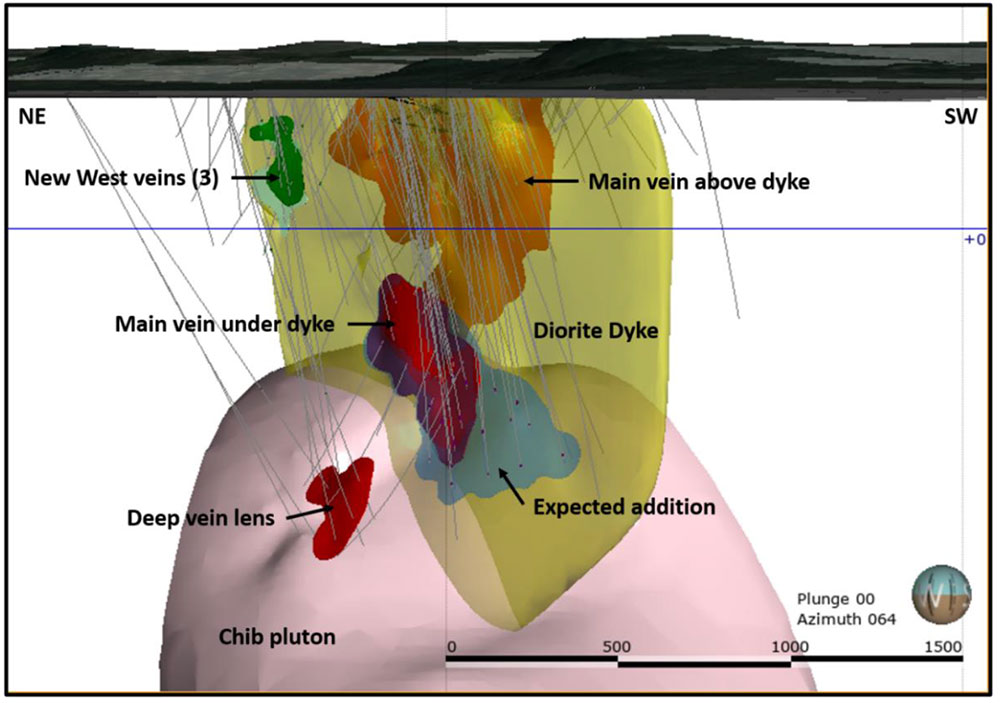

“As the implementation of ore sorting opens up new alternatives for the mill that require additional analysis, the Company is now planning to have the preliminary economic assessment (PEA) completed by the end of the first quarter of 2022. In addition, it will incorporate an updated mineral resource for Corner Bay which will include positive drill results that now connect the area between the Main Zone (below the dyke) and the Lower Deep Vein. We expect to have all the assay results in January. This area is expected to add significant tonnage as it is now considered waste in the current resource.”

Ore Sorting Tests

Corem was commissioned to undertake test work at their facility in Québec City to establish the amenability of the Corner Bay mineralized material to ore sorting using an XRT sensor.

A representative bulk sample was prepared by Doré Copper by selecting rocks from the development mineralized material stockpiled at surface from the project site. The material was selected to represent different rock types: semi and massive sulphides, shear zone, diorite dyke and anorthosite. At Corem’s facility, each rock type was crushed to less than 1 ½ inches (38 millimeters or mm) and screened at ¾ inch (19 mm). The fractions between 1 ½ inches and ¾ inches of each rock type were blended in different proportion to compose a representative bulk sample prior sorting. An industrial 1 m belt width COMEX OCXR-1000 integrated X-ray and optical sorting system was used and only the dual energy X-ray transmission (DE-XRT) sensor was used for the testing.

The ore sorting process helps concentrate the metals of commercial interest, which were principally associated with high density sulphide minerals. During this process, rocks were individually scanned, and low grade (low density) waste material is selectively diverted away from downstream processing. As a first step, the XRT sensor was calibrated with 100 different rocks representing all rock types and a calibration algorithm was developed for the Corner Bay material. A continuous production run was done on a 95 kg sample. The testing was done with three passes where the reject material from each pass was re-processed by the sorter. This methodology allowed to vary a large range of operating conditions and to establish a grade-recovery curve, useful to evaluate different separation scenarios.

The sum of the three pre-concentrates represented 37.2% of the feed mass at a grade of 6.84% Cu and resulted in a cumulative copper recovery of 95.5%. The final reject portion represented 62.8% of the initial mass at a grade of 0.19% Cu representing 4.5% of the copper fed in the sorter. Fines from the crushing operation, grading 3.26% Cu, were not included in the ore sorting test. Some fines were generated, but as the rock types were crushed separately the crushing proportions were not considered for calculations. Therefore, in an operating application where the fine material fraction would join the pre-concentrate, the final pre-concentrate grade would be lower and the recovery would be higher than indicated by this test.

Potential Benefits of Ore Sorting

Sorting of the run-of-mine (ROM) material has the potential to reduce operating costs for milling, flotation and tailings management since it corresponds to a significant rejection of low-grade material. Sorting could decrease the hardness of the ore sent to the mill, and so, non-negligeable energy savings could be foreseen. The Bond Work Index (Wi) of the ore sorter pre-concentrate was determined to be 11.0 kWh/t by Corem. This is 20% less than the historical Wi of 13.7 kWh/t for the Corner Bay ore. The commensurate increase in the head grade of the ore reporting to the flotation circuit has the potential to also result in improved metallurgical recoveries in the flotation circuit and higher concentrate grades.

Additionally, it is anticipated that potential savings in capital costs related to the smaller milling and flotation circuit would partially offset the costs associated with the ore sorter or provide capacity to treat additional material from other deposits in the region in the Copper Rand mill.

Based on the success of this first test, an ore sorting trade-off study will be integrated into the Company’s upcoming PEA.

Qualified Persons

Ernest Mast, P.Eng., President and CEO of the Corporation and a “Qualified Person” within the meaning of National Instrument 43-101, has reviewed and approved the technical information contained in this news release.

About Corem

Corem is a center of expertise and innovation in mineral processing with the largest concentration of resources dedicated to research and development in this field in Canada. Corem is a not-profit organization that works closely with its members, its clients, and its partners to improve competitiveness and to reduce environmental impact through the industrialization of innovative solutions. Corem has extensive equipment and infrastructure, including a pilot plant and laboratories for grinding, physical separation (gravimetric and magnetic), flotation, extractive metallurgy, hydrometallurgy, pelletizing, thermal treatment processes as well as mineralogical characterization. For more information, please visit: corem.qc.ca

About Doré Copper Mining Corp.

Doré Copper Mining Corp. aims to be the next copper producer in Québec with a production target of +50 Mlbs of copper equivalent annually by implementing a hub-and spoke operation model with multiple high-grade copper-gold assets feeding its centralized 2,700 tonnes per day mill. The Corporation is expected to deliver a PEA by the end of the first quarter of 2022 and then initiate a feasibility study and permit applications.

The Corporation has consolidated a large land package in the prolific Lac Doré/Chibougamau and Joe Mann mining camps that has produced 1.6 billion pounds of copper and 4.4 million ounces of gold1. The land package includes 13 former producing mines, deposits and resource target areas within a 60-kilometre radius of the Corporation’s Copper Rand Mill.

For further information, please contact:

Ernest Mast

President and Chief Executive Officer

Phone: (416) 792-2229

Email:

Laurie Gaborit

VP Investor Relations

Phone: (416) 219-2049

Email:

For more information, please visit: www.dorecopper.com

Facebook: Doré Copper Mining

LinkedIn: Doré Copper Mining Corp.

Twitter: @DoreCopper

Instagram: @DoreCopperMining

1. Sources for historic production figures: Economic Geology, v. 107, pp. 963–989 – Structural and Stratigraphic Controls on Magmatic, Volcanogenic, and Shear Zone-Hosted Mineralization in the Chapais-Chibougamau Mining Camp, Northeastern Abitibi, Canada by François Leclerc et al. (Lac Doré/Chibougamau mining camp) and NI 43-101 Technical Report on the Joe Mann Property dated January 11, 2016 by Geologica Groupe-Conseil Inc. for Jessie Ressources Inc. (Joe Mann mine).

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. Specific forward-looking statements in this press release include, but are not limited to, higher copper recovery would be expected as fine materials from the mining and crushing operations would join the ore sorter pre-concentrate; expectations that ore sorting could also be successful at Devlin; future development work will include additional ore sorting tests in different areas of the deposits; planning to have the preliminary economic assessment (PEA) completed by the end of the first quarter of 2022; incorporating an updated mineral resource for Corner Bay; expecting to have all drill results in January; area between the Main Zone (below the dyke) and the Lower Deep Vein expected to add significant tonnage; potential to reduce operating and capital costs with ore sorting technology; aiming to be the next copper producer in Québec with a production target of +50 Mlbs of copper equivalent annually by implementing a hub-and spoke operation model; initiating a feasibility study and permit applications after the PEA.

All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the timing and ability of the Corporation to receive necessary regulatory approvals, and the plans, operations and prospects of the Corporation and its properties are forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to, actual exploration results, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required regulatory approvals, health emergencies, pandemics and other exploration or other risks detailed herein and from time to time in the filings made by the Corporation with securities regulators. Although the Corporation has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

- 2024-07-24 Dore Copper confirms copper mineralization on its Cedar Bay Southwest Extension

- 2024-07-03 Dore Copper enters into an Agreement to acquire claims next to its flagship Corner Bay High-Grade Copper deposit

- 2024-06-20 Dore Copper announces 2024 annual and special meeting results

- 2024-04-19 Dore Copper announces grant of stock options and deferred share units

- 2024-03-27 Dore Copper identifies gold exploration potential at Norhart Zone, just North of the former Joe Mann mine

- 2024-02-26 Dore Copper announces Management changes

- 2024-01-22 Doré Copper increases size of its Joe Mann Property by acquiring a 65% interest in 3,030 hectares

- 2024-01-02 Doré Copper announces closing of rights offering

- 2023-11-21 Doré Copper announces rights offering

- 2023-10-30 Dore Copper reports excellent concentrate grades and recoveries with low impurity element concentrations from flotation tests at its Corner Bay project

- 2023-10-17 Doré Copper reports exploration drill results – intersects shallow mineralization grading 4.4 g/t Au over 9.8 metres at Gwillim

- 2023-08-01 Doré Copper provides update on its project activities

- 2023-06-06 Doré Copper announces closing of $2.8 million non-brokered private placement of common shares and flow-through shares

- 2023-05-29 Doré Copper reports High-Grade Gold mineralization at Gwillim including 9.67 g/t au over 5.3 metres