Download PDF English | French | GERMAN

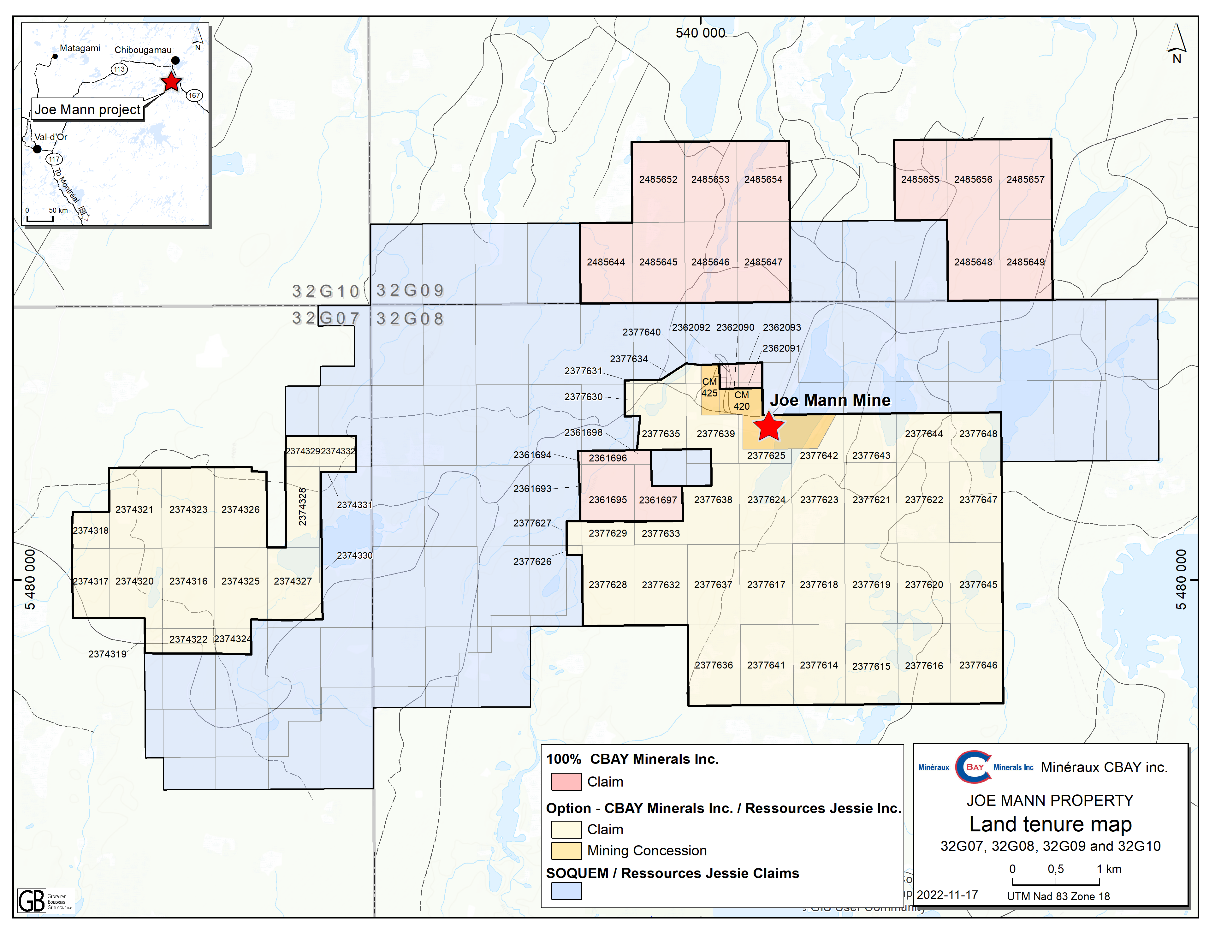

Toronto, Ontario – November 22, 2022 – Doré Copper Mining Corp. (the “Corporation” or “Doré Copper“) (TSXV: DCMC; OTCQX: DRCMF; FRA: DCM) is pleased to announce the final results from its 2022 drilling program on its flagship Corner Bay property, located in the Chibougamau mining camp, approximately 40 kilometers by road from Chibougamau, Québec. In 2022, Doré Copper has completed 44 holes totaling 38,405 meters and is reporting today the assay results from the last 12 holes.

This drilling program is part of the feasibility study work to upgrade the Inferred Mineral Resource to the Indicated category. Another infill drilling program of approximately 2,000 meters is planned at Devlin for the first quarter of 2023.

Drilling Highlights

Main Vein below dyke

- CB-22-86: 5.1 meters of 5.68% Cu, 0.32 g/t Au, 18.3 g/t Ag, and 510 ppm Mo

- CB-22-83: 2.6 meters of 3.69% Cu, 10.3 g/t Ag, and 414 ppm Mo

Main Vein above dyke

- CB-22-96: 3.3 meters of 2.53% Cu, 0.40 g/t Au and 2.1 meters of 4.73% Cu, 0.23 g/t Au, 45.5 g/t Ag, and 401 ppm Mo

Ernest Mast, President and CEO of Doré Copper, commented, “We have completed nearly 40,000 meters of drilling at Corner Bay in 2022, mostly infill drilling required for the feasibility study. Overall, the results confirm the continuity of the copper mineralization in the deposit. We have also identified a number of holes from 2004 with high-grade copper mineralization in the upper portion of the deposit that were not incorporated in the mineral resource. It is our intention to continue the Corner Bay infill drilling program in 2023 following the exploration drilling at the Doré Ramp and Joe Mann as detailed in the September 12, 2022 news release. Subject to improved market conditions and additional funding, we now expect to complete the feasibility study in 2024.”

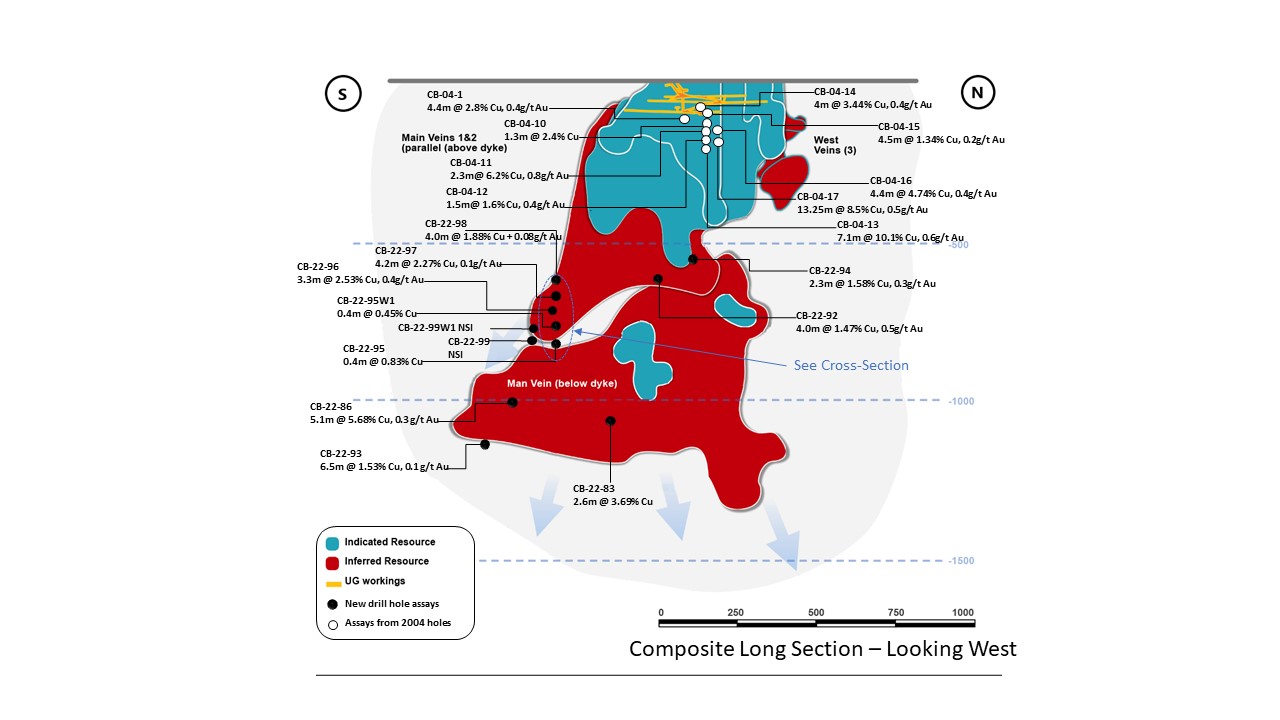

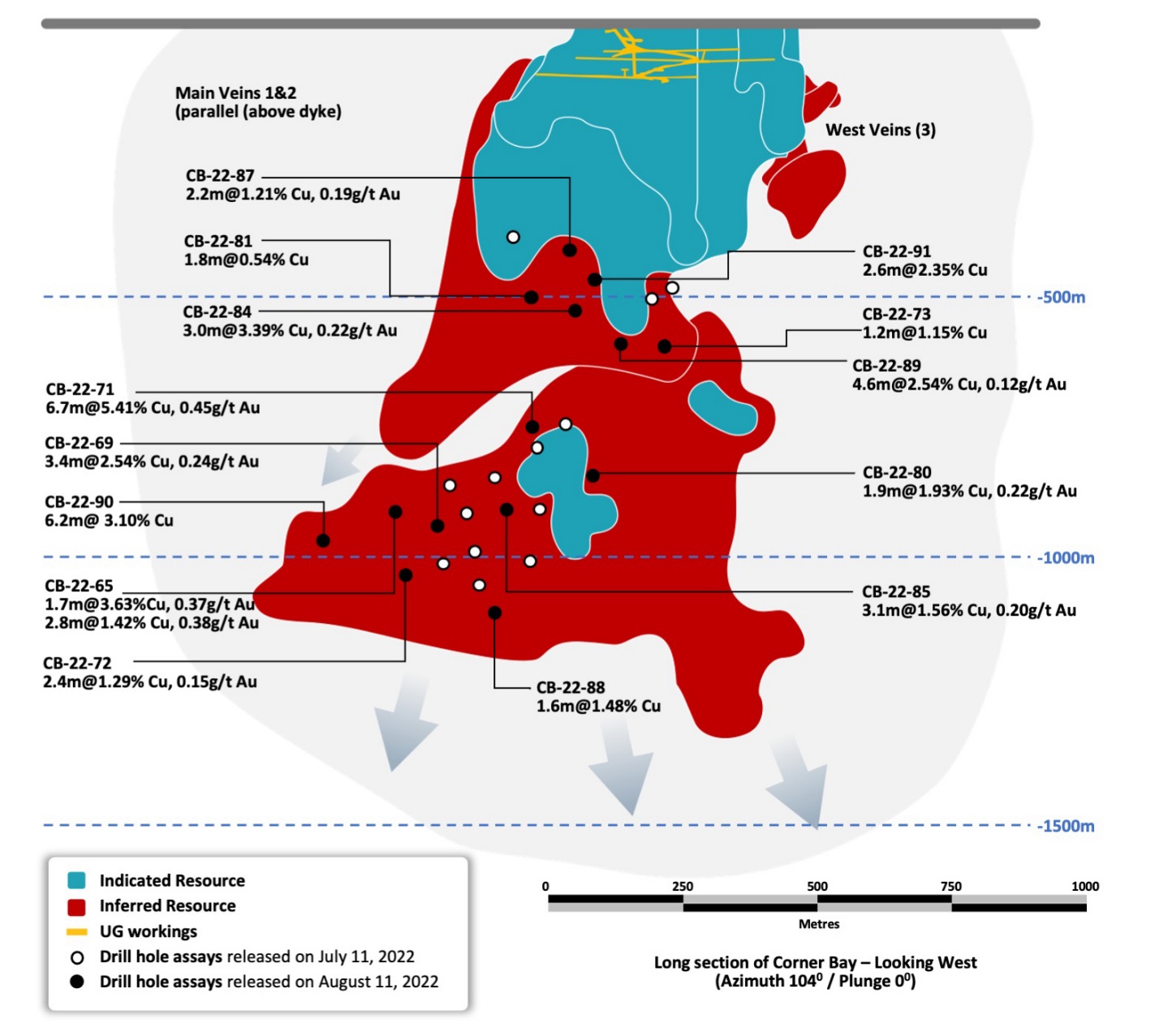

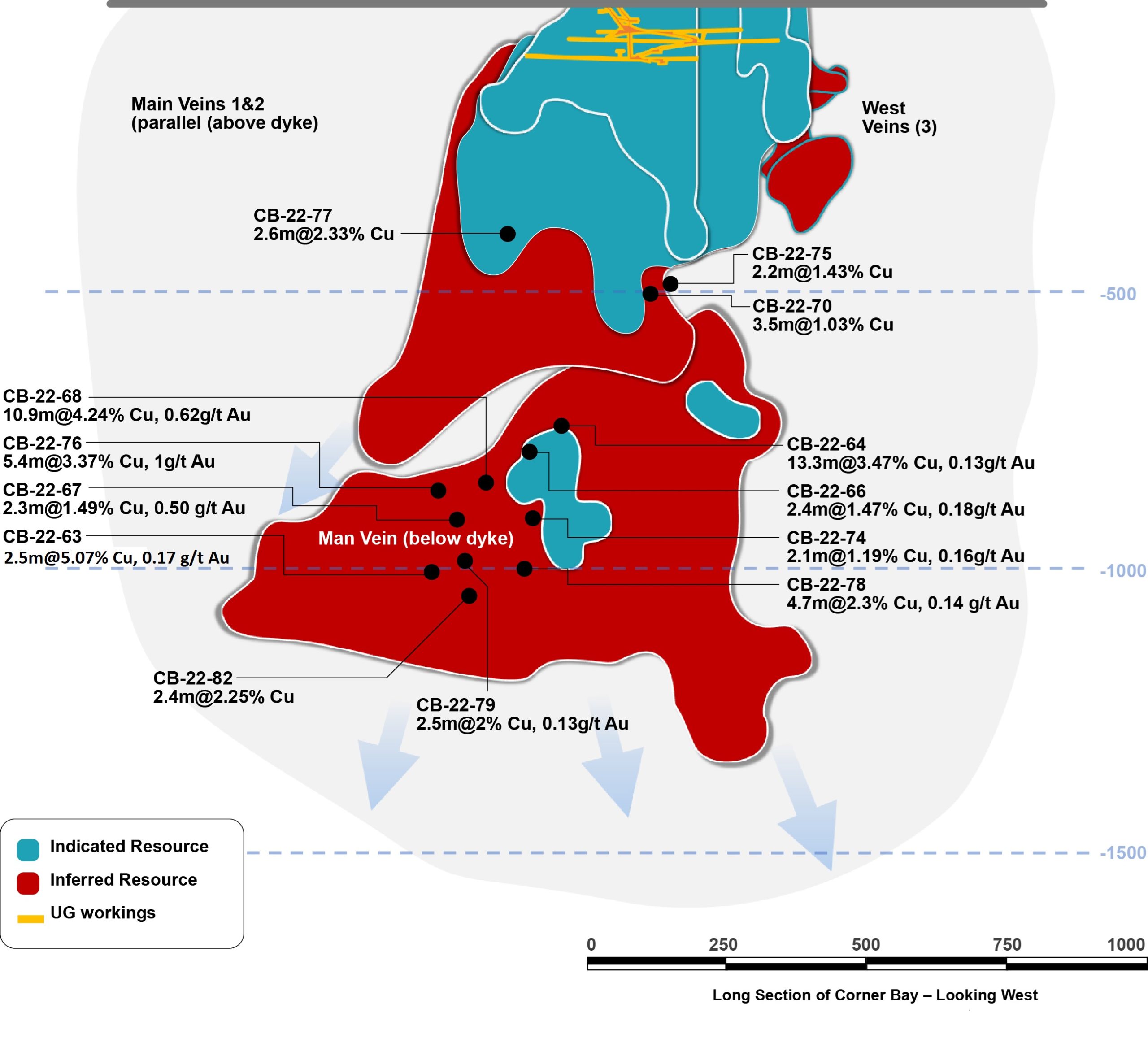

Corner Bay Drilling Program

The drilling program which started in early 2022 is designed to infill the Corner Bay deposit at a 50 to 60 meter spacing from surface to a depth of 1,000 meters. From today’s results, 9 holes intersected the Main Vein above the dyke and the remaining 3 holes intersected the Main Vein below the dyke. The results are continuing to confirm the continuity of the copper mineralization for the Main Vein above and below the dyke (Figure 1 and Table 1).

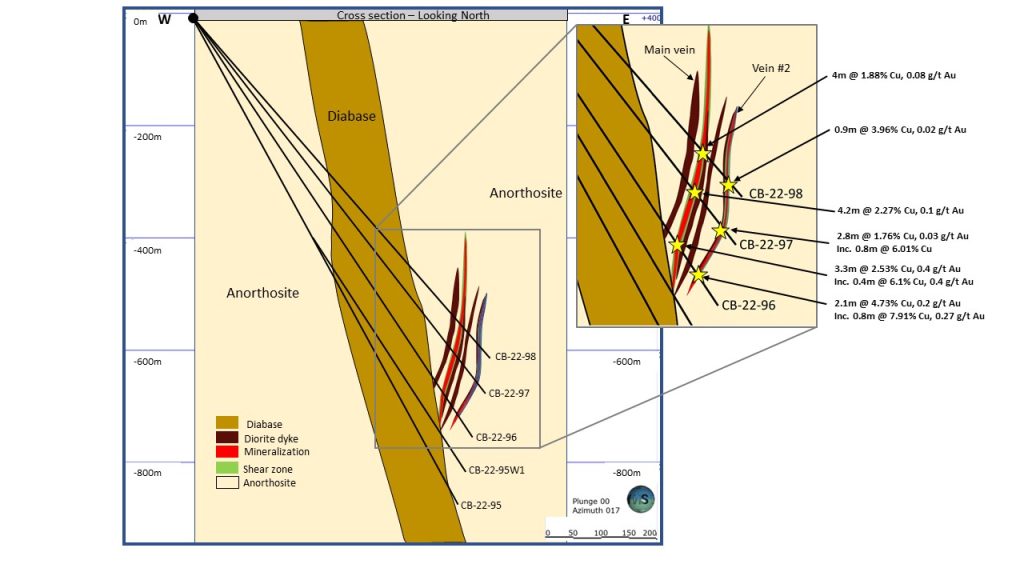

The results today have defined the presence and continuity of a second vein located 50 meters east of the Main Vein above the dyke (Figure 2). This second vein has been intersected by six drill holes to date (CB-21-53, 58, 60 and CB-22-96, 97 and 98) and remains open up-dip. Mineralization in this area appears to be parallel and controlled by mafic dykes, interpreted as originating from the Chibougamau Pluton. Hole CB-21-53 intersected 2.0 meters of 3.34% Cu, 0.56 g/t Au, and 15.6 g/t Ag (February 8, 2022 news release), hole CB-21-58 intersected 0.6 meter of 0.9% Cu, and hole CB-21-60 intersected 1.6 meters of 1.27% Cu.

Following a review of the required drilling for the feasibility study, the Company has identified nine (9) holes from 2004 that were excluded from the current mineral resource estimate (see Figure 1 and Table 2). All holes intersected copper mineralization at a shallow depth in the two subparallel veins (Main Veins) above the dyke. Significant high-grade intercepts included:

- CB-04-13: 7.07 meters of 10.09% Cu, 0.61 g/t Au

- CB-04-15: 13.0 meters of 3.23% Cu, 0.38 g/t Au

- CB-04-17: 13.25 meters of 8.52% Cu, 0.51 g/t Au

Corner Bay Deposit

In the Preliminary Economic Assessment announced on May 10, 2022, the Mineral Resource estimate (“MRE”) for Corner Bay contains an Indicated Resource of 2.68 Mt at 2.66% Cu and 0.26 g/t Au containing 157 million pounds of copper and 22,000 ounces of gold and an Inferred Resource of 5.86 Mt at 3.43% Cu and 0.27 g/t Au containing 443 million pounds of copper and 51,000 ounces of gold, based on a cut-off grade of 1.3% Cu and a copper price of US$3.75 per pound (refer to Technical Report dated June 15, 2022)1. The Corner Bay deposit contains significant silver and molybdenum which have not been included in the prior MREs. The feasibility study will include the addition of silver and molybdenum as by-products.

The Corner Bay deposit is hosted by the intrusive Lac Doré Complex on the southern flank of the Chibougamau anticline. A regional north-northeastern diorite dyke also cuts the area. Several significant shear zones oriented north-south and northwest-southeast have been identified in the area. The Corner Bay area is characterized by copper porphyry style mineralization and by copper mineralization in shear zones commonly associated with dykes related to the Chibougamau Pluton.

Table 1. Corner Bay Recent Drill Assays Highlights from the 2022 Drill Program

| Hole | From (m) | To (m) | Width1 (m) | Cu (%) | Au (g/t) | Ag (g/t) | Mo (ppm) | Zone |

|---|---|---|---|---|---|---|---|---|

| CB-22-83 | 1,063.3 | 1,065.9 | 2.6 | 3.69 | 0.07 | 10.3 | 414 | MV below dyke |

| CB-22-86 | 1,067.7 | 1,072.8 | 5.1 | 5.68 | 0.32 | 18.3 | 510 | MV below dyke |

| CB-22-92 | 754.5 | 758.5 | 4.0 | 1.47 | 0.45 | 10.1 | 699 | MV above dyke |

| CB-22-93 | 1,184.7 | 1,191.2 | 6.5 | 1.53 | 0.11 | 5.3 | - | MV below dyke |

| CB-22-94 | 692.0 | 694.3 | 2.3 | 1.58 | 0.35 | 12.1 | 236 | MV above dyke |

| CB-22-95 | No significant mineralization | MV above dyke | ||||||

| CB-22-95W1 | No significant mineralization | MV above dyke | ||||||

| CB-22-96 | 807.7 | 811.0 | 3.3 | 2.53 | 0.40 | 21.2 | 1,877 | MV above dyke |

| 852.5 | 854.6 | 2.1 | 4.73 | 0.23 | 45.5 | 401 | MV above dyke V2 | |

| CB-22-97 | 761.9 | 766.1 | 4.2 | 2.27 | 0.10 | 14.4 | 406 | MV above dyke |

| 823.1 | 825.9 | 2.8 | 1.76 | 0.03 | 5.4 | - | MV above dyke V2 | |

| including | 824.2 | 825.0 | 0.8 | 6.01 | 0.09 | 18.2 | 370 | “ |

| CB-22-98 | 726.4 | 730.4 | 4.0 | 1.88 | 0.08 | 6.2 | 527 | MV above dyke |

| 776.6 | 777.5 | 0.9 | 3.96 | 0.02 | 14.1 | 322 | MV above dyke V2 | |

| CB-22-99W1 | No significant mineralization | MV above dyke | ||||||

| CB-22-99 | No significant mineralization | MV above dyke |

- The true width of the structures intersected is estimated at approximately 60-75% of the downhole width. Main Vein = MV.

Table 2. Corner Bay 2004 Drill Assays Highlights not Included in MRE

| Hole | From (m) | To (m) | Width1 (m) | Cu (%) | Au (g/t) | Ag (g/t) | Mo (ppm) | Zone |

|---|---|---|---|---|---|---|---|---|

| CB-04-01 | 132.28 | 136.66 | 4.38 | 2.80 | 0.35 | NA | NA | MV above dyke |

| 140.62 | 147.06 | 6.44 | 2.12 | 0.33 | NA | NA | MV above dyke | |

| CB-04-10 | 138.27 | 139.57 | 1.3 | 2.44 | 0.30 | NA | NA | MV above dyke |

| 141.0 | 143.86 | 2.86 | 2.71 | 0.25 | NA | NA | MV above dyke | |

| CB-04-11 | 146.4 | 148.73 | 2.33 | 6.24 | 0.79 | NA | NA | MV above dyke |

| CB-04-12 | 180.62 | 182.14 | 1.52 | 1.58 | 0.37 | NA | NA | MV above dyke |

| CB-04-13 | 213.03 | 220.1 | 7.07 | 10.09 | 0.61 | NA | NA | MV above dyke |

| CB-04-14 | 105.82 | 109.83 | 4.01 | 3.44 | 0.39 | NA | NA | MV above dyke |

| CB-04-15 | 100.12 | 104.59 | 4.47 | 1.34 | 0.21 | NA | NA | MV above dyke |

| 112.34 | 125.34 | 13.0 | 3.23 | 0.38 | NA | NA | MV above dyke | |

| CB-04-16 | 158.19 | 162.54 | 4.35 | 4.74 | 0.39 | NA | NA | MV above dyke |

| CB-04-17 | 181.73 | 194.98 | 13.25 | 8.52 | 0.51 | NA | NA | MV above dyke |

- The true width of the structures intersected is estimated at approximately 50-70% of the downhole width. Main Vein = MV

Drilling and Quality Control

The Company is using Miikan Drilling as the drilling contractor. Miikan is a joint venture between Chibougamau Diamond Drilling Ltd., the First Nations community of Ouje-Bougoumou and the First Nations community of Mistissini both located in the Eeyou Istchee territory.

Sample preparation and analysis within the mineralized zones are completed at AGAT Laboratories in Mississauga, Ontario. For AGAT, samples are weighed, dried, crushed to 75% passing 2 mm, split to 250 g, and pulverized to 85% passing 75 microns. Samples are then fire assayed for Au (50 g) and 4 acid digest ICP-OES finish for 43 elements. Outside the mineralized zones, sample preparation is completed at SGS Canada Inc. in Val-d’Or, Québec and analysis (fire assay and ICP analysis) is completed at SGS Canada Inc. in Burnaby, B.C. Samples are weighed, dried, crushed to 75% passing 2 mm, split to 250 g, and pulverized to 85% passing 75 microns. Samples are then fire assayed for Au (50 g) and sodium peroxide fusion ICP-MS finish for 34 elements.

QA/QC is done in house by Doré Copper Geologists with oversight from the Vice President Exploration. The check samples (blanks and standards – 4% of total samples with another 2% of core duplicates) that were inserted into the sample batches are verified against their certified values and are deemed a pass if they are within three standard deviations of the certified value. The duplicates are evaluated against each other to determine mineralization distribution (nugget). If there are large discrepancies in the check samples, then the entire batch is requested to be re-assayed.

Sylvain Lépine, M.Sc, P.Geo., Vice President Exploration of the Corporation and a “Qualified Person” within the meaning of National Instrument 43-101, has reviewed and approved the technical information contained in this news release.

About Doré Copper Mining Corp.

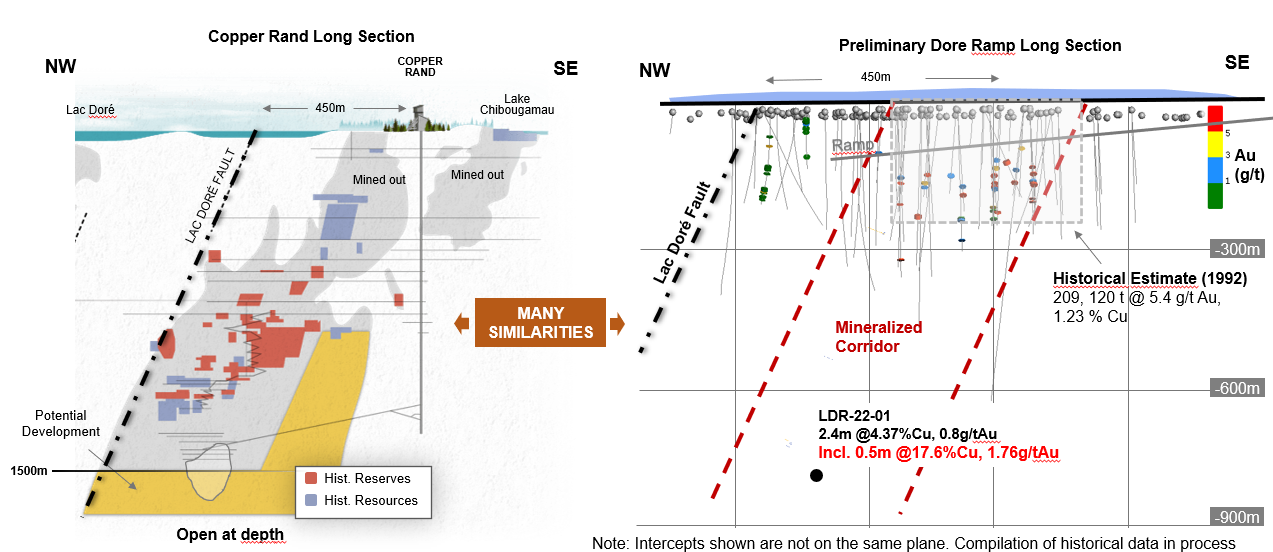

Doré Copper Mining Corp. aims to be the next copper producer in Québec with an initial production target of +50 million pounds of copper equivalent annually by implementing a hub-and spoke operation model with multiple high-grade copper-gold assets feeding its centralized Copper Rand mill1. The Corporation has delivered its PEA in May 2022 and is proceeding with a feasibility study.

The Corporation has consolidated a large land package in the prolific Lac Doré/Chibougamau and Joe Mann mining camps that has historically produced 1.6 billion pounds of copper and 4.4 million ounces of gold2. The land package includes 13 former producing mines, deposits and resource target areas within a 60-kilometer radius of the Corporation’s Copper Rand Mill.

For more information, please visit: www.dorecopper.com

Facebook: Doré Copper Mining

LinkedIn: Doré Copper Mining Corp.

Twitter: @DoreCopper

Instagram: @DoreCopperMining

- Technical report titled “Preliminary Economic Assessment for the Chibougamau Hub-and-Spoke Complex, Québec, Canada” dated June 15, 2022, in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The Technical Report was prepared by BBA Inc. with several consulting firms contributing to sections of the study, including SLR Consulting (Canada) Ltd., SRK Consulting (Canada) Inc. and WSP Inc.

- Sources for historic production figures: Economic Geology, v. 107, pp. 963–989 – Structural and Stratigraphic Controls on Magmatic, Volcanogenic, and Shear Zone-Hosted Mineralization in the Chapais-Chibougamau Mining Camp, Northeastern Abitibi, Canada by François Leclerc et al. (Lac Dore/Chibougamau mining camp) and NI 43-101 Technical Report on the Joe Mann Property dated January 11, 2016 by Geologica Groupe-Conseil Inc. for Jessie Ressources Inc. (Joe Mann mine).

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian and United States securities legislation. Forward-looking statements include, but are not limited to, statements with respect to the use of proceeds of the Offering, the timing and ability of the Corporation to receive necessary regulatory approvals, including the final acceptance of the Offering from the TSX Venture Exchange, the renunciation to the purchasers of the Flow-Through Shares and timing thereof, the tax treatment of the Flow-Through Shares, the Corporation’s ability to meet its production target, the commencement, timing and completion of a feasibility study, and the plans, operations and prospects of the Corporation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive regulatory approvals; the price of gold and copper; and the results of current exploration. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

- 2024-07-24 Dore Copper confirms copper mineralization on its Cedar Bay Southwest Extension

- 2024-07-03 Dore Copper enters into an Agreement to acquire claims next to its flagship Corner Bay High-Grade Copper deposit

- 2024-06-20 Dore Copper announces 2024 annual and special meeting results

- 2024-04-19 Dore Copper announces grant of stock options and deferred share units

- 2024-03-27 Dore Copper identifies gold exploration potential at Norhart Zone, just North of the former Joe Mann mine

- 2024-02-26 Dore Copper announces Management changes

- 2024-01-22 Doré Copper increases size of its Joe Mann Property by acquiring a 65% interest in 3,030 hectares

- 2024-01-02 Doré Copper announces closing of rights offering

- 2023-11-21 Doré Copper announces rights offering

- 2023-10-30 Dore Copper reports excellent concentrate grades and recoveries with low impurity element concentrations from flotation tests at its Corner Bay project

- 2023-10-17 Doré Copper reports exploration drill results – intersects shallow mineralization grading 4.4 g/t Au over 9.8 metres at Gwillim

- 2023-08-01 Doré Copper provides update on its project activities

- 2023-06-06 Doré Copper announces closing of $2.8 million non-brokered private placement of common shares and flow-through shares

- 2023-05-29 Doré Copper reports High-Grade Gold mineralization at Gwillim including 9.67 g/t au over 5.3 metres