Download PDF English | French | GERMAN

Toronto, Ontario – April 21, 2022 – Doré Copper Mining Corp. (the “Corporation” or “Doré Copper“) (TSXV: DCMC; OTCQX: DRCMF; FRA: DCM) announces positive results from two drill holes totaling 819 metres completed in late 2021 on the western part of the Gwillim property, which is under a 50/50 joint venture with Argonaut Gold Inc. (through its wholly owned subsidiary Prodigy Gold Inc.). Gwillim is located approximately 8 kilometers by road northwest of Chibougamau, Québec.

Drilling Highlights

KOD-21-02

- 3.33 g/t Au over 13.3 meters, including 26.8 g/t Au over 1.0 metre and 23.2 g/t Au over 0.5 meter

- 3.39 g/t Au over 3.0 meters

- 10.14 g/t Au over 4.0 meters

KOD-21-03

- 3.03 g/t Au over 4.0 meters

- 4.64 g/t Au over 6.0 meters, including 11.69 g/t Au over 2.0 meters

Ernest Mast, President and CEO of Doré Copper, commented, “Today’s results on the Gwillim’s KOD zone demonstrate good continuity of the mineralization and have extended its depth to 400 meters vertical. We are in the process of compiling and re-evaluating all the historical data for the Gwillim mine and the KOD zone. Once completed, we and our JV partner Argonaut Gold Inc. will plan a drilling program to test the strike and depth extension of both deposits. On our main deliverable for the year, we expect to have the results of the preliminary economic assessment (PEA) for our hub-and-spoke operation model by mid-Q2 2022.”

Gwillim Drilling Program

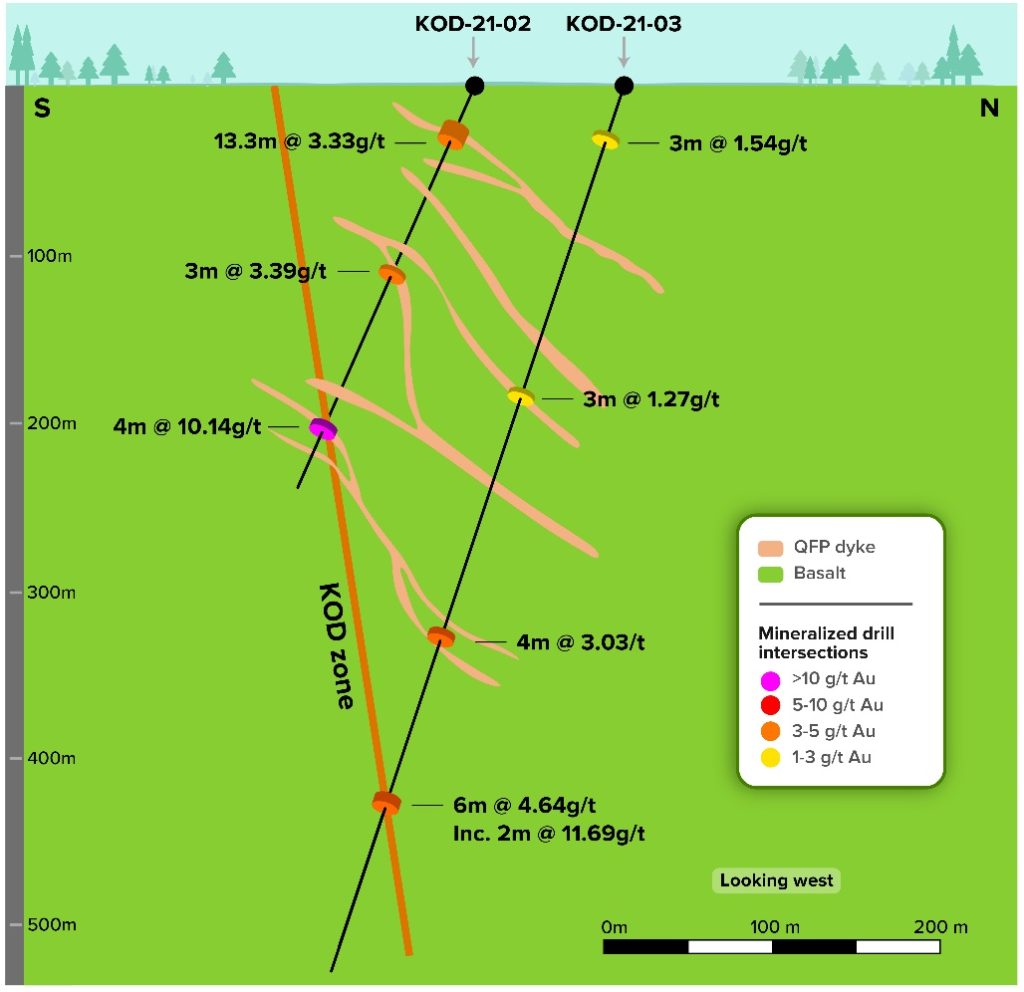

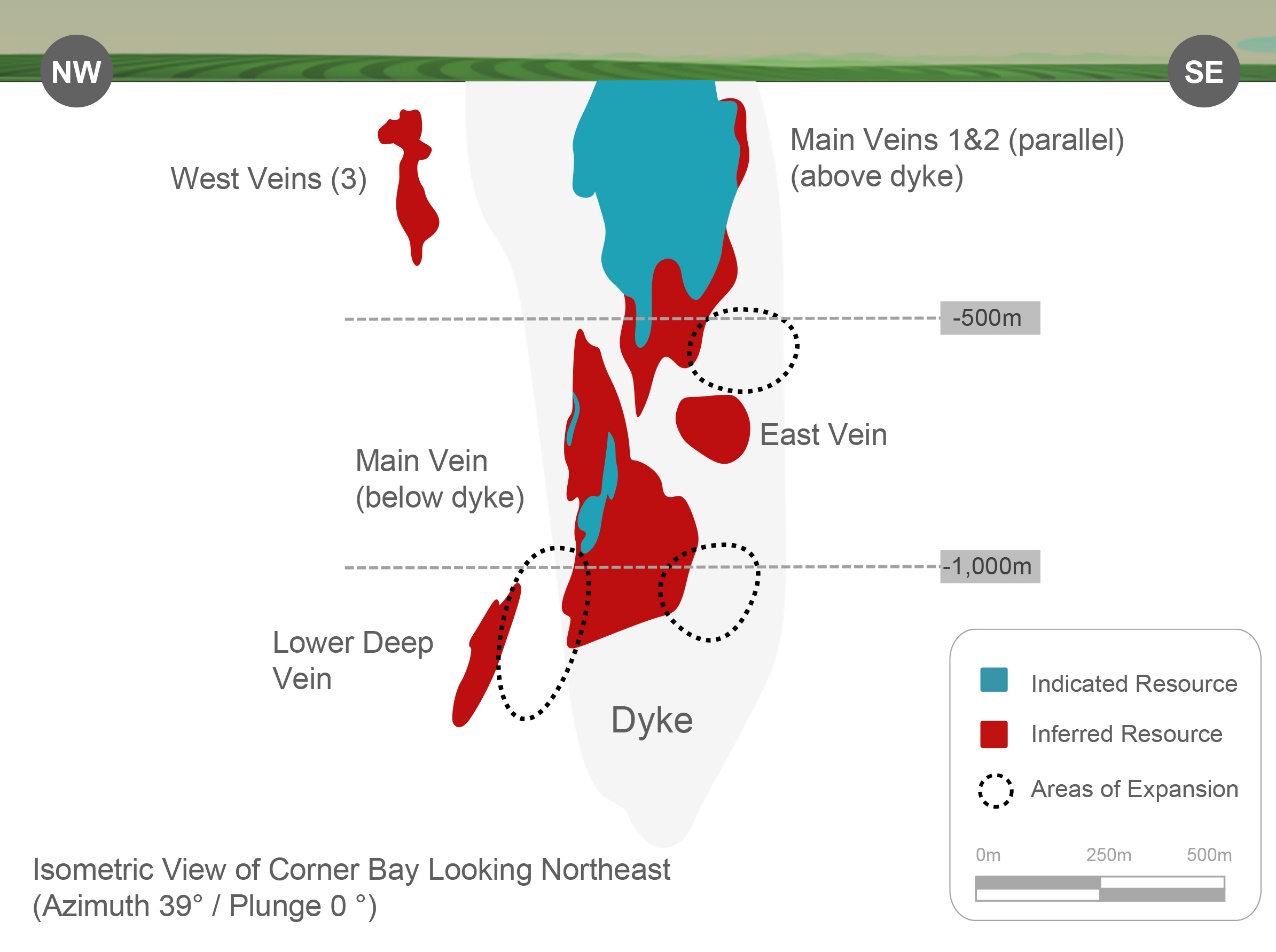

Doré Copper drilled two holes in September 2021 to test the KOD zone, located 300 meters south of the mined Gwillim Main zone (Figure 1 and Table 1). Hole KOD-21-02 intersected three mineralized zones, including a 13.3 meter zone grading 3.33 g/t starting at a vertical depth of approximately 25 meters and an intercept of 4.0 meters at 10.14 g/t Au, which is interpreted as the KOD zone. Hole KOD-21-03, drilled 100 meters north-northwest of KOD-21-02, intersected two mineralized zones and demonstrated the continuity of the KOD zone at depth (Figure 2). The second mineralized zone, 6.0 meters at 4.64 g/t Au extended the KOD zone vertically by approximately 50 meters from prior historical intercepts (historical drill holes locations are approximate and will be georeferenced in the coming months) and is the deepest intersection to date at a vertical depth of 400 meters.

Gwillim Property

The Gwillim property totals 486 ha. The western part of the property (385 ha) is under a 50/50 joint venture between Dore Copper and Argonaut Gold Inc. (through its wholly owned subsidiary Prodigy Gold Inc.) with Dore Copper being the operator. The eastern part of the property (102 ha) is 100% owned by Dore Copper.

Located on the joint venture land, the Gwillim mine operated between 1974 and 1976 and again from 1980 to 1984. In total 254,066 short tons were mined at a grade of 4.79 g/t Au1. Most of the production came from the Main zone, which extended along strike for 122 meters with an average width of 2.6 meters and up to a depth of 114 metres.

In 1987, two high-grade intercepts of 7.0 meters at 33 g/t Au and 7.9 meters at 17.9 g/t Au were drilled by Greenstone Resources Ltd. at moderate depths of 200 to 300 meters at the KOD zone (300 meters south of the mined Gwillim Main zone)2. A further 25 holes were drilled from the surface before a ramp was developed and the zone was further explored from underground in 1988 but not mined (some development through ore). In 1989, three more surface holes were drilled to depths of 400 meters with one hole confirming the extension of the high-grade mineralization beyond 300 meters vertical depth. An internal report from 1989 outlined a small historical resource (not NI 43-101 compliant) for the KOD Zone. No other significant exploration activities are reported after this work.

Gwillim is hosted within the Roy group in the Bruneau Formation, in pillowed basalts and gabbroic sill. Mineralization is hosted predominantly within east-west, steeply dipping structures containing quartz-carbonate veins with limited amounts of massive sulphides. At KOD, there are two parallel east-west vein zones, approximately 50 meters apart, with the mineralization predominantly occurring in the northernmost vein. The thickness of the mineralization varies between 0.3 and 5.0 meters. The KOD zone is open along strike and downdip to the east under the Gwillim lake.

References:

1 Structural and Stratigraphic Control on Magmatic, Volcanogenic, and Shear Zone-Hosted Mineralization in the Chapais-Chibougamau Mining Camp, Northeastern Abitibi, Canada – Leclerc et al., 1992 Society of economic geologist inc. V 107, pp. 963-989.

2 Diamond Drilling Report on the Gwillim Lake KOD Zone, Greenstone Resources (internal report) – Robert McIntosh, Project Geologist, Flanagan McAdam and Company, December 1989.

Table 1. Gwillim Assays Highlights from the 2021 Drill Program1

| Hole | From (m) | To (m) | Width1 (m) | Au (g/t) | Zone |

|---|---|---|---|---|---|

| KOD-21-02 | 28.7 | 42.0 | 13.3 | 3.33 | unnamed |

| including | 28.7 | 29.2 | 0.5 | 23.2 | unnamed |

| including | 41.0 | 42.0 | 1.0 | 26.8 | unnamed |

| 138.5 | 141.5 | 3.0 | 3.39 | unnamed | |

| 203.5 | 207.5 | 4.0 | 10.14 | KOD | |

| KOD-21-03 | 395.0 | 399.0 | 4.0 | 3.03 | unnamed |

| 448.5 | 454.5 | 6.0 | 4.64 | KOD | |

| Including | 448.5 | 450.5 | 2.0 | 11.69 | KOD |

Qualified Person

Andrey Rinta, P.Geo., the Exploration Manager of the Corporation and a “Qualified Person” within the meaning of National Instrument 43-101, has reviewed and approved the technical information contained in this news release.

About Doré Copper Mining Corp.

Doré Copper Mining Corp. aims to be the next copper producer in Québec with an initial production target of +50 Mlbs of copper equivalent annually by implementing a hub-and spoke operation model with multiple high-grade copper-gold assets feeding its centralized 2,700 tonnes per day mill. The Corporation is expected to deliver a PEA by mid-Q2 2022 and then initiate a feasibility study and permit applications.

The Corporation has consolidated a large land package in the prolific Lac Doré/Chibougamau and Joe Mann mining camps that has produced 1.6 billion pounds of copper and 4.4 million ounces of gold 3. The land package includes 13 former producing mines, deposits and resource target areas within a 60-kilometre radius of the Corporation’s Copper Rand Mill.

For further information, please contact:

Ernest Mast

President and Chief Executive Officer

Phone: (416) 792-2229

Email:

Laurie Gaborit

VP Investor Relations

Phone: (416) 219-2049

Email:

For more information, please visit: www.dorecopper.com

Facebook: Doré Copper Mining

LinkedIn: Doré Copper Mining Corp.

Twitter: @DoreCopper

Instagram: @DoreCopperMining

- Sources for historic production figures: Economic Geology, v. 107, pp. 963–989 – Structural and Stratigraphic Controls on Magmatic, Volcanogenic, and Shear Zone-Hosted Mineralization in the Chapais-Chibougamau Mining Camp, Northeastern Abitibi, Canada by François Leclerc et al. (Lac Dore/Chibougamau mining camp) and NI 43-101 Technical Report on the Joe Mann Property dated January 11, 2016 by Geologica Groupe-Conseil Inc. for Jessie Ressources Inc. (Joe Mann mine).

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. Specific forward-looking statements in this press release include, but are not limited to the Corporation and its JV partner Argonaut Gold Inc. planning a drilling program to test the strike and depth extension of both deposits; aiming to be the next copper producer in Québec with an initial production target of +50 Mlbs of copper equivalent annually; PEA by mid-Q2 2022; implementing a hub-and spoke operation model; and initiating a feasibility study and permit applications after the PEA.

All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the timing and ability of the Corporation to receive necessary regulatory approvals, and the plans, operations and prospects of the Corporation and its properties are forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to, actual exploration results, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required regulatory approvals, health emergencies, pandemics and other exploration or other risks detailed herein and from time to time in the filings made by the Corporation with securities regulators. Although the Corporation has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

- 2024-04-19 Dore Copper announces grant of stock options and deferred share units

- 2024-03-27 Dore Copper identifies gold exploration potential at Norhart Zone, just North of the former Joe Mann mine

- 2024-02-26 Dore Copper announces Management changes

- 2024-01-22 Doré Copper increases size of its Joe Mann Property by acquiring a 65% interest in 3,030 hectares

- 2024-01-02 Doré Copper announces closing of rights offering

- 2023-11-21 Doré Copper announces rights offering

- 2023-10-30 Dore Copper reports excellent concentrate grades and recoveries with low impurity element concentrations from flotation tests at its Corner Bay project

- 2023-10-17 Doré Copper reports exploration drill results – intersects shallow mineralization grading 4.4 g/t Au over 9.8 metres at Gwillim

- 2023-08-01 Doré Copper provides update on its project activities

- 2023-06-06 Doré Copper announces closing of $2.8 million non-brokered private placement of common shares and flow-through shares

- 2023-05-29 Doré Copper reports High-Grade Gold mineralization at Gwillim including 9.67 g/t au over 5.3 metres

- 2023-05-15 Dore Copper announces grant of stock options and deferred share units

- 2023-05-08 Doré Copper announces up to $3 million non-brokered private placement of common shares and flow-through shares

- 2023-05-03 Doré Copper to Drill High Priority Copper-Gold Targets This Summer in Chibougamau, Quebec